The market ethos of making money can't stop

The market duly pulled off a big rally, with the U.S. dollar heading for the black, the Japanese yen tumbling and the Australian dollar falling to an 11-year low, but gold was trading in the opposite direction.

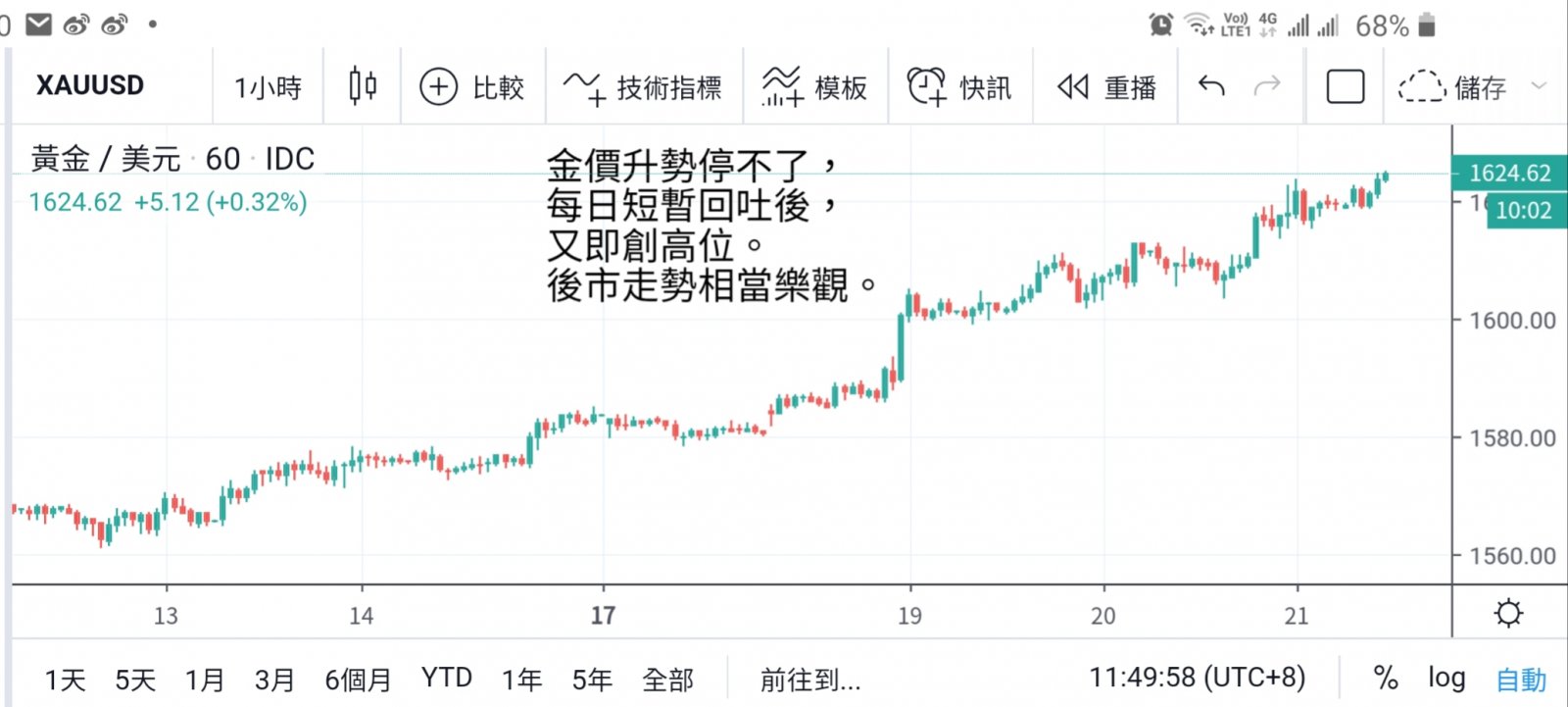

Gold continued to challenge new highs as it hit a seven-year high and breached the 1620 mark. Trend more breakthroughs, still as expected walk, investors long and short lines are appropriate,

In the right direction, we will be able to continue to ride the wealth through train, profitable.

The weighted index of meihui appeared # 3 white samurai, rising for the third consecutive day, and the index was 99.91, the highest since April 2017. The risk of recession continued to weigh on the yen,

The dollar also posted its biggest two-day gain against the yen since September 17. The Australian dollar also fell to an 11-year low against the greenback. But gold climbed to a seven-year high on safe-haven demand,

Gold last night hit a new high of $1,623.7, its highest since February 15, 2013, and is still hovering near that high this morning. Market ethos, opportunities everywhere.

Stock markets have reacted to concerns about the impact of a new coronavirus on the performance of major companies, despite a decline in U.S. stocks, but recent strong U.S. economic data,

Other economies, by contrast, have not seen a strong recovery, supporting the dollar. The U.S. manufacturing sector showed signs of stabilizing, and federal reserve vice chairman larry clarida on Thursday issued an upbeat economic outlook,

He noted that the U.S. economy showed no signs of losing momentum, and that he was not overly alarmed by the possibility that the outbreak could change the fed's interest-rate policy.

Despite a brief reaction to the outbreak, the dollar index has been strong, the U.S. economy is on solid footing, the dollar is on track to break the psychological 100-mark, and non-u.s. currencies will remain under general pressure.

But despite a stronger dollar, enthusiasm for gold has not waned. Supported by low global interest rates, gold's medium-term rally trend will not change. Even after missing the fed's chance to cut rates last year,

But last year's rise was only the beginning of a surge in gold prices, which broke through the psychological $1,600 barrier just after the start of 2020.

These two nights to see the high gold price will make a proper correction, but immediately before the close to continue to hit the high, and continue to have buying support trend, investors can continue to advance three steps, step back form,

Buy, until the emergence of significant pressure adjustment, the profit will be rich.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram