Pneumonia fears hit dollar gold again

Markets were surging last week, the dollar at best, gold 飊 rise, the market for a new type of coronavirus to worry again, U.S. stocks turned down over the weekend,

The outbreak of community infection in Japan and South Korea, the super infector and the passengers on the mishandled cruise ship, all caused a sharp increase in the number of infected people in Japan and South Korea.

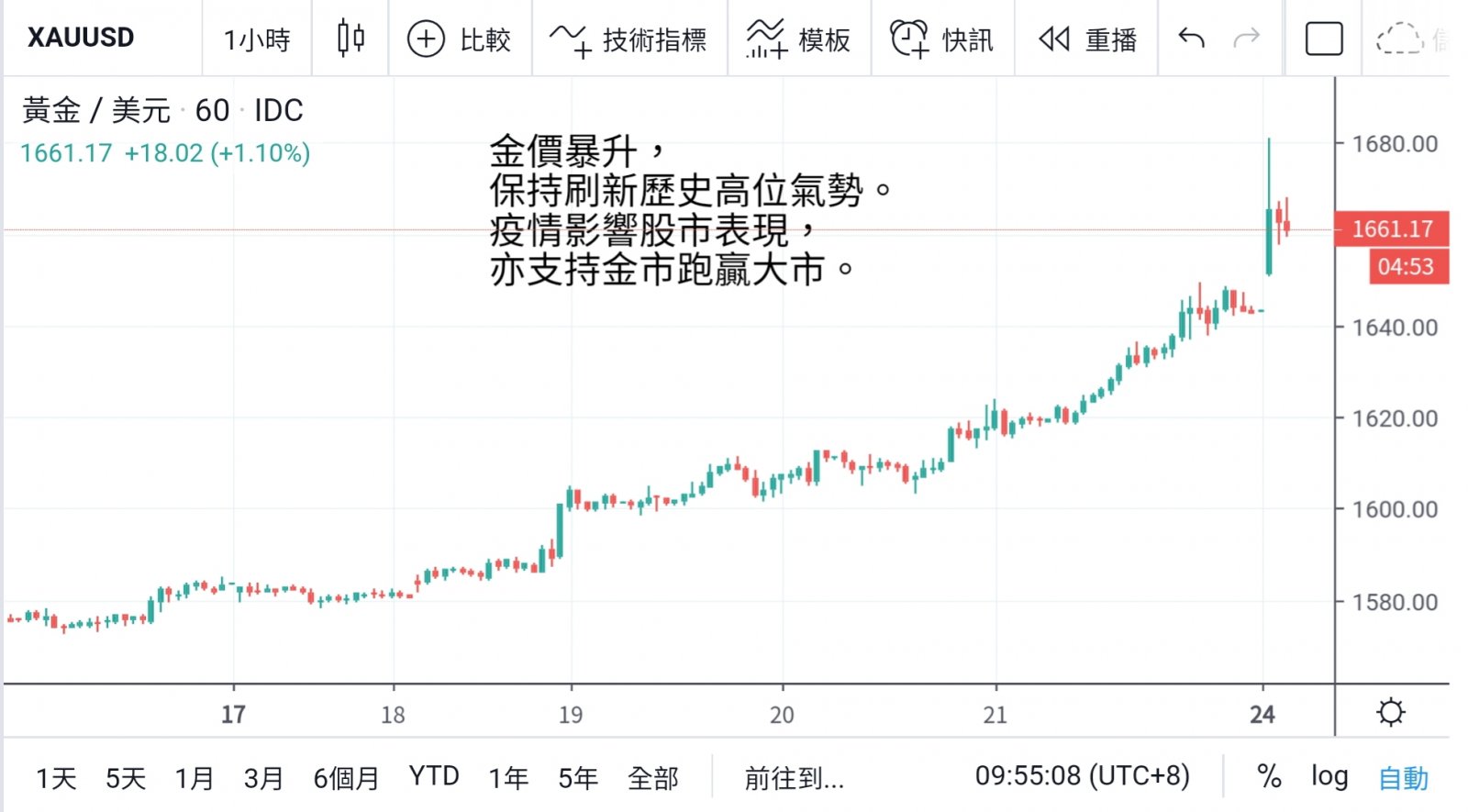

The gold market, which surged 3 percent last week, jumped to a peak of 1,680 on Monday, the highest since February 2013, as Banks ratcheted up the price's long-term performance and the rally is expected to continue.

The weighted index rose last week to 99.91, its highest level since April 2017, on fears about the impact of the new coronavirus.

Economies around the world are bound to suffer, but recent strong U.S. economic data and the continued absence of a recovery in other economies have seen the dollar perform well and the euro slip through the 1.08 mark.

Sterling also traded below 1.3, while the yen posted its biggest two-day drop in recent memory last week. With signs of stabilization in U.S. manufacturing and continued strength in the labor market, the dollar is still on track to break through the psychological 100 mark despite a correction late Friday.

On the other hand, despite the dollar's strength, the market is more focused on gold as a haven. Gold got a big boost from low global interest rates, and the fed's rate-setting record last week,

The fed will be watching closely for the impact of the new coronavirus on the economy, and markets will be looking to the European central bank,

And the people's bank of China will increase monetary policy to rescue the market, gold prices in addition to play a hedge function, also become investors hedging tool. With the exception of a slight correction on Monday, when it broke through 1650,

Up to 1680 before a little rest, rising wave after wave. The rise in gold prices is still only the beginning of a surge in gold prices.

Economic data this week, the market will continue to be affected by the pneumonia outbreak sentiment, under the general pressure on the stock market, the gold market is also expected to be supported in the short term. Several big Banks have upgraded their forecasts for the year,

It is widely expected that the gold market will continue to outperform the broader market with a 10 percent increase. However, as the rally is also quite rapid, gold prices will move back and forth more rapidly.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram