Worry about a drag on the economy big global epidemic 冧 city

Global stock markets tumbled on Monday as global risk sentiment rose, with several countries losing ground and a new outbreak of the coronavirus threatening to undermine global economic growth.

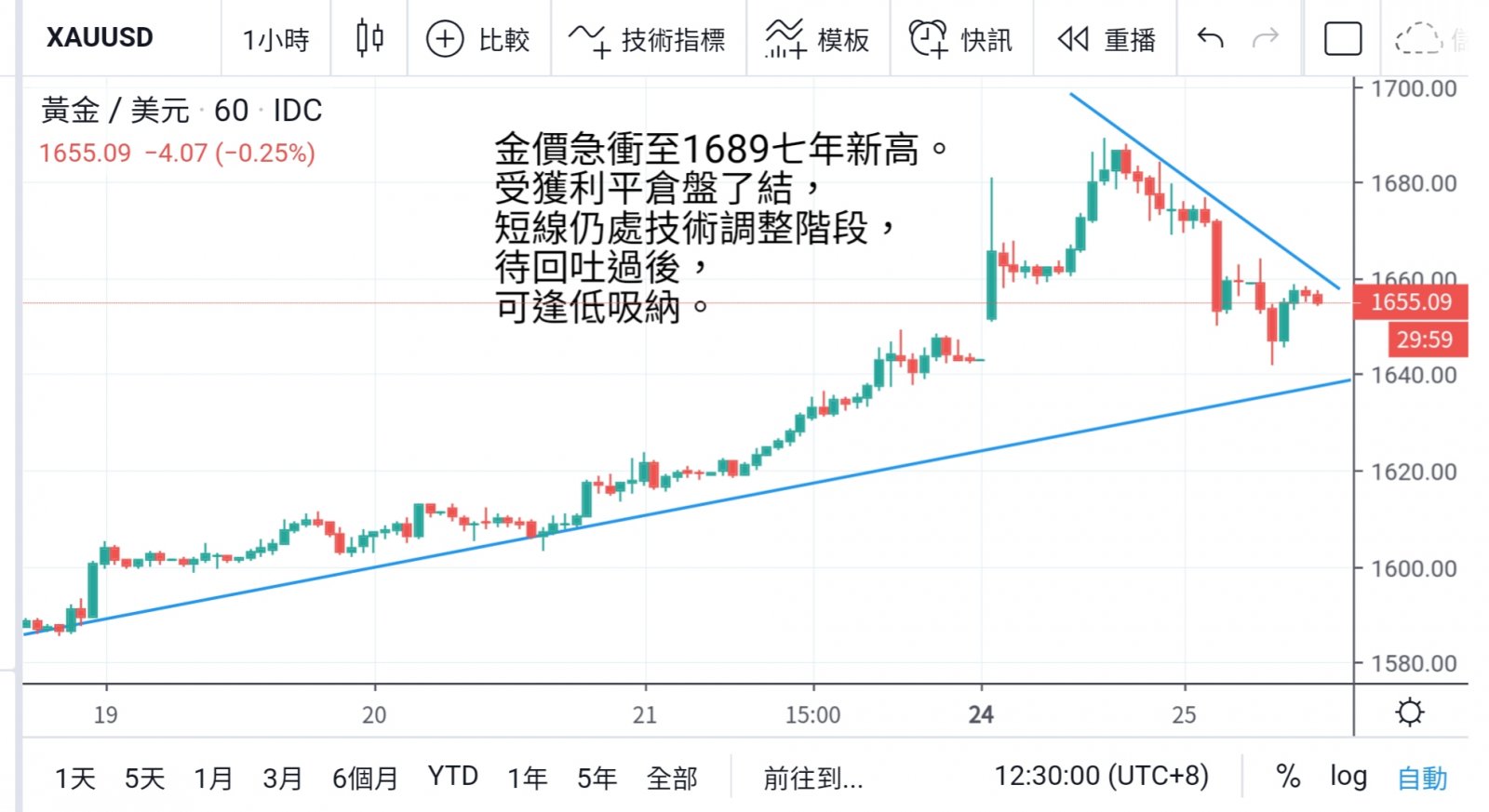

Gold also hit its highest level since January 2013. However, the market was so depressed that the price of gold pared the day's gains at the end of the day following the emergence of profit liquidation, and fell to 1643 this morning before rebounding.

Markets continue to be buffeted by the news of the outbreak, and volatility is starting to widen. After a steep drop of more than 1,000 points yesterday, there was a rebound in demand for correction, but there was still no optimism.

As soon as the market opened yesterday, the gold price rose sharply. Outbreaks in Japan, South Korea and Italy have led to a sharp increase in the number of infected people.

The market is worried that economic growth will be a drag, capital into the precious metals market safety; The price of gold rose through the 1650 and 1670 levels to a seven-year high of $1,689 in Europe,

After the period gradually back soft. As investors continued to worry about the economy after the market opened, the dow Jones industrial average extended its losses after opening 590 points lower.

It eventually fell more than 1,000 points, with the s&p and nasdaq each falling more than 3 percent.

After surging to a new seven-year high, the gold market was hit by an unwinding of profits, falling as low as $1,642 this morning despite little change in market fundamentals.

But the gold market technical trend adjustment, will be the first consolidation to break through again up, on the short term, the gold market after a greater opportunity to back up, first try low, to make up.

There are a number of U.S. economic data releases tonight that are not as important as they need to be. Recent signs of stabilization in the manufacturing sector could support the dollar if the data is done well. And the gold market can wait to back up, then bargain hunting.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram