Can not hold up the stock market funds from the gold market out of cover

U.S. stocks, which fell for a seventh straight session and are on track for their worst week since the financial crisis, are set to take a beating tonight as markets look for help.

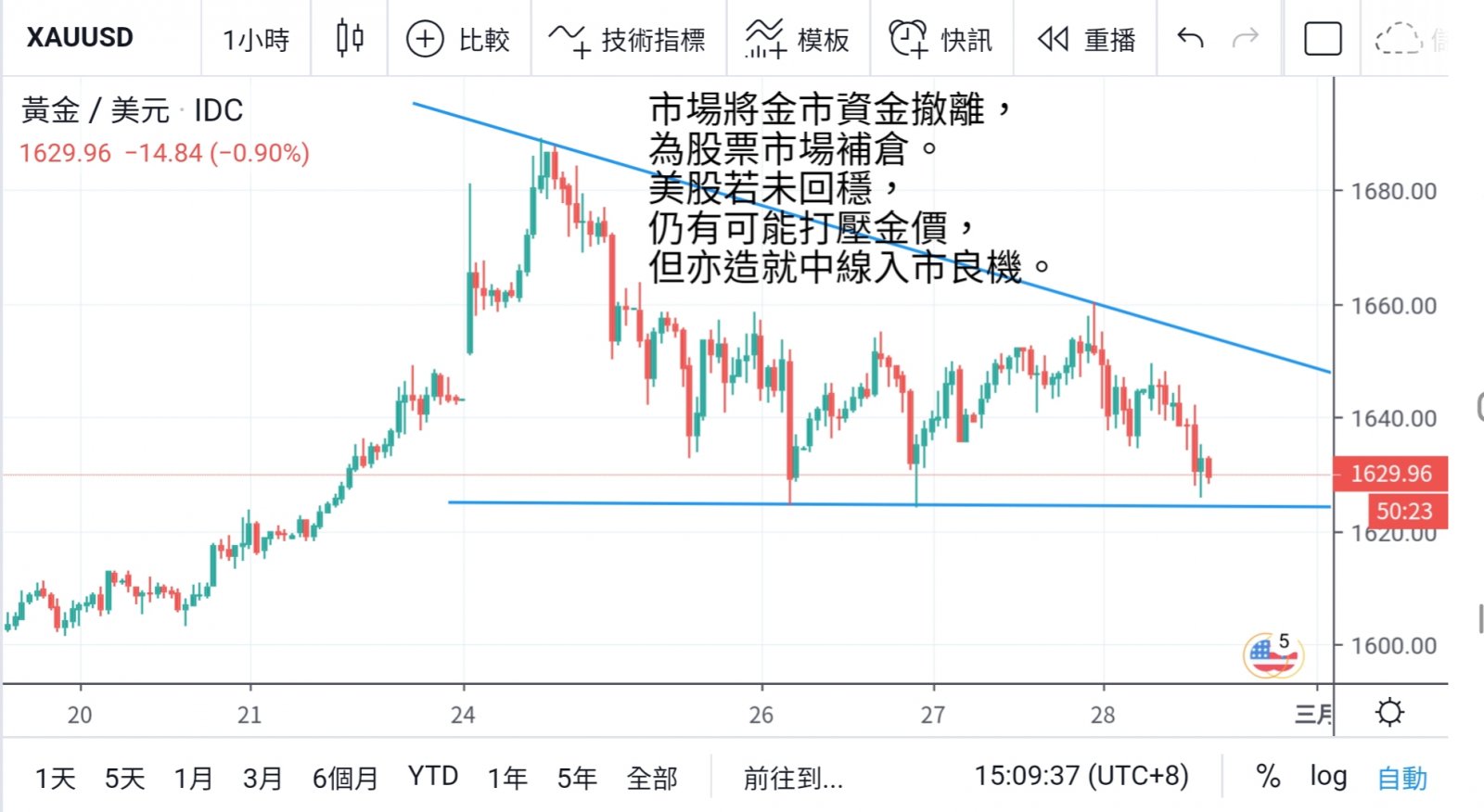

However, as the U.S. stock market fell too fast, fund institutions and even retail investors needed to cover their short positions for the stock market, which led to the unwinding of profits from the gold market and the repatriation of funds to the stock market, thus dragging down the performance of the gold market.

Has gradually reflected in the long - term market opportunities, can begin to prepare for the gold city center line strategy.

With the outbreak of pneumonia, the fear index rose sharply, the us debt yield rose one after another, the us Treasury and the us dollar came under pressure, and non-us currencies generally rose yesterday, with the euro back above 1.10, but the gold market was only stable.

Gold had risen earlier in the day, peaking at $1,660 in the us, but fell sharply as us stocks continued their correction, with the dow falling 10 per cent for seven consecutive sessions.

The panic index shot up to 15%, the market was in a mess, and money was scarce. There was no room to flee to the safe haven.

Gold fell further today to $1,626, close to a weekly low.

The fed is under increasing pressure to cut rates. With a major stock market correction on Wall Street and a widespread belief that stocks can't hit new highs without heading lower, traders mostly see a higher likelihood of a fed rate cut.

It has even begun to expect the fed to cut rates as early as march. Latest interest rate futures show a 68% chance of a 25 basis point cut in March and a 50% chance of a cut in April,

The probability of two rate cuts before June is even higher at 74%. The consensus is that the United States needs to act, but until that happens, U.S. stocks will remain bearish, which could sway other markets.

There are a number of U.S. economic data releases tonight, among which the price index and Michigan root consumer sentiment index are more important. The data is expected to be good, which should provide support for the dollar. Gold is down about 5% from its high,

If we lose 1626 again, we may fall back to 1611. However, this level also has a median absorption value. After the U.S. stock market starts to recover, it is believed that with the support of global low interest rates,

There is still hope that gold prices will start to stabilize and resume their rally, allowing investors to wait until the correction is complete before jumping into the market again.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram