US Federal Reserve Urgently Cut Interest Rate by 1%, Market Panic Rises

The rescue could not stop. The Federal Reserve cut interest rates by another 1% and New Zealand's Central Bank cut interest rates by 4.3% yesterday. Market panic surged and the stock market continued to fall.

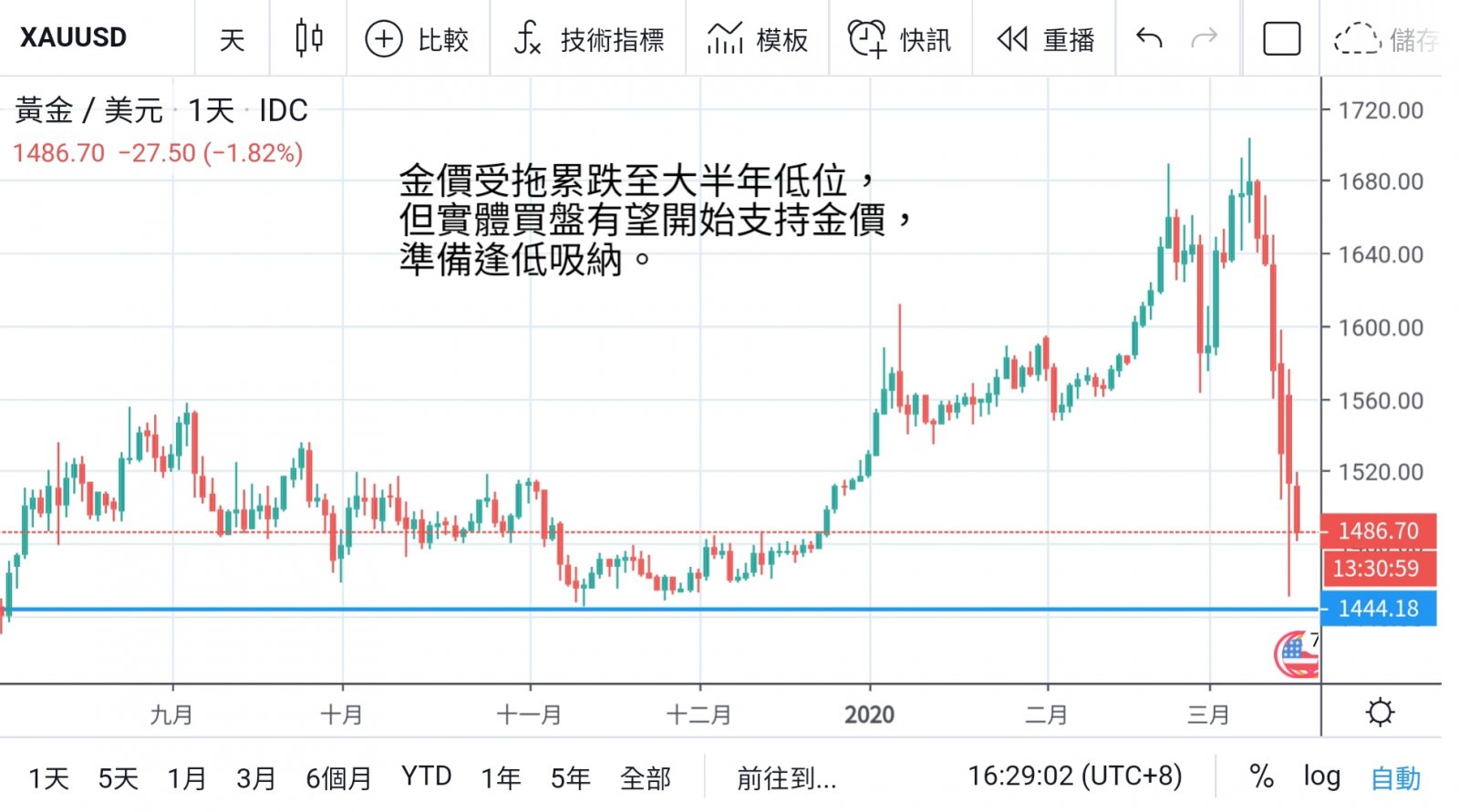

The more the market rescued, the more flustered it was. Gold prices were also affected. The trend was like a roller coaster. After a sharp rebound, it hit a low level in half a year. The market was still worried about the shortage of funds.

Hot money flows out of precious metal market to replenish stocks. The Federal Reserve cut interest rates by 1% on Monday, another emergency cut after the beginning of March, with a total of 1.5% cut on both occasions.

And restart the quantitative easing monetary policy, restart the printing press to save the market. U.S. President Trump even predicted that the new coronal pneumonia epidemic would plunge the U.S. economy into recession.

News scattered the world's stock markets. U.S. stocks fluctuated extremely and the trend did not improve.

U.S. stocks suffered the worst decline since the financial tsunami. Apart from triggering the market suspension mechanism again, the Dow Jones Industrial Average is closer to the 20,000 mark. Trump described the epidemic as an invisible enemy.

The problem that emerged was that no one could have expected it a month ago. Now we see all kinds of such problems. The problem is very serious, really very serious.

He said the epidemic might plunge the United States into recession, stressing that what is currently under consideration is how to deal with the epidemic. Asked when the epidemic situation could be properly handled, he pointed out that it was estimated that from July to August,

At this stage, it is not yet planned to implement isolation measures nationwide, but some regions and hot spots may need isolation, emphasizing that it is not yet time to implement relevant policies.

In addition to the United States, central banks around the world have also adopted monetary policies. Unfortunately, financial markets are still weak in confidence and U.S. stocks continue to plummet. Apart from benefiting from a sharp rise in the early opening of the market, gold prices have tumbled after reaching European markets.

After the gold price jumped to a steep level yesterday, as the stock market continued to fall, the gold price was dragged back to soft, and the impact of shrinking industrial uses such as silver was even worse.

Silver lost US$ 13 and gold price also fell below the 1500 mark. After entering the US market, gold prices rebounded sharply after reaching a minimum of 1,450 US dollars. At this stage,

Although the global stock market slump has dragged down the capital crisis and many financial institutions are believed to need to make up their positions and cut their positions, the global central bank's joint efforts to print silver paper will begin to bring long-term support to gold.

1450 More Physical Buying to Support Gold Prices; Technically, the short-term volatility of gold prices continues, but it is no longer appropriate to sell short at low prices. Instead, we can seize the opportunity to enter the market at low prices.

Ready to bargain for goods, as long as the stock market stabilizes, funds will begin to seek rescue and hedge and flow into the gold market.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram