Gold Takes the Lead to Win Most Markets

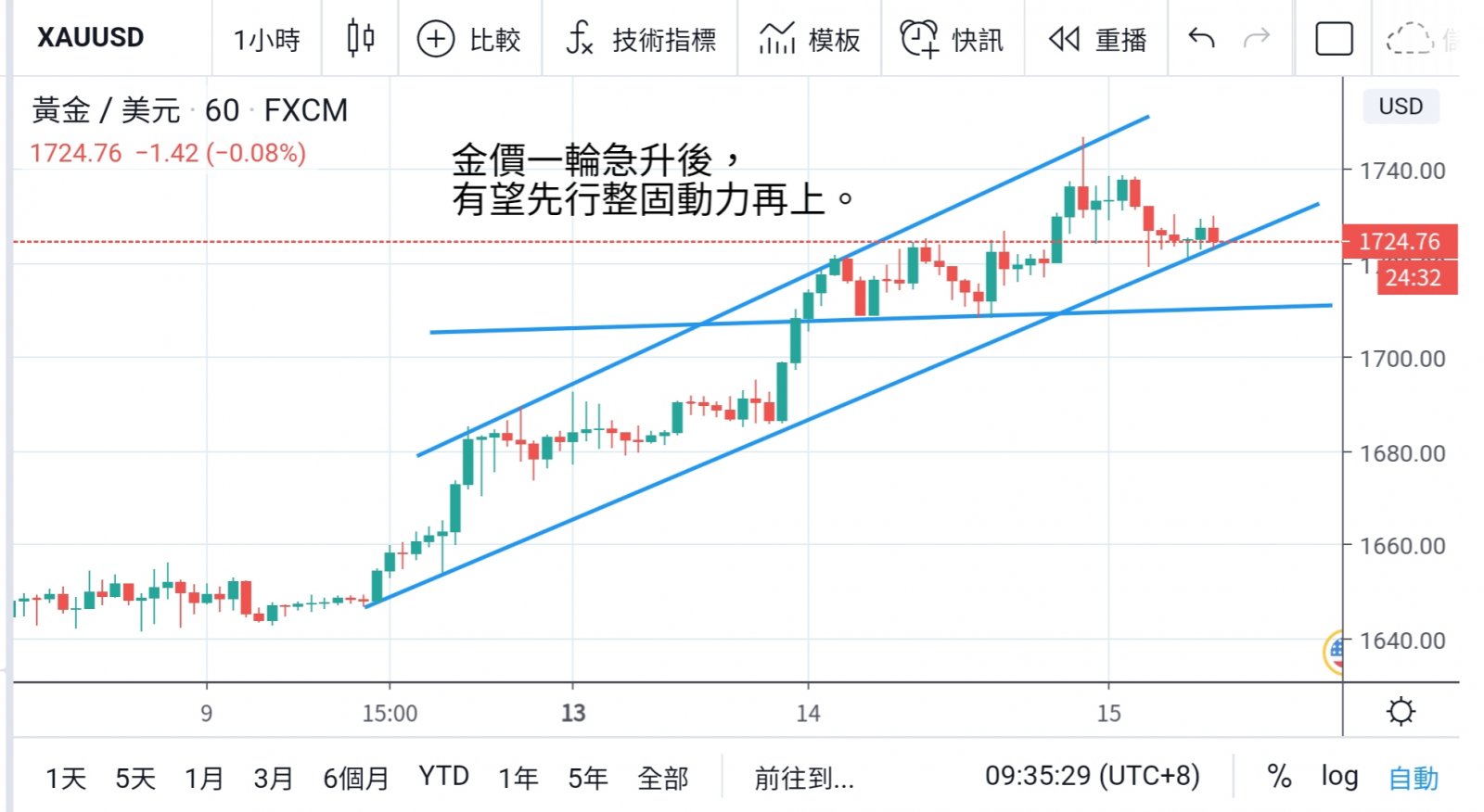

Gold prices hit another seven-year high. The worst of the epidemic is expected to have passed and the Dow Jones Industrial Average has begun to rebound. However, the economy is still afraid of falling, stimulating the market's demand for gold as a safe haven.

Gold prices beat the big markets, hitting a new seven-year high. tonight, many heavy data are coming back to observe the impact of the epidemic on the economy.

The United States will announce the monthly retail sales rate for March, which was -0.5% before the data and -8% expected. "Terror Data" Dramatically Declines,

The risk of recession in the US economy is bound to increase, and the US dollar, gold and other markets are likely to see a big market. If the data released at that time are worse than the already pessimistic market expectations,

Gold may be boosted. The epidemic will continue to worsen U.S. economic data, and increased debt pressure will also trigger more gold hedging purchases.

Therefore, the gold price is expected to continue its upward trend in the second quarter, with a high point breaking 1800 USD/oz. As the liquidity crisis slows down, the US dollar may return to normal.

That is, following the decline of important U.S. economic data and weakening. As a result, the probability of gold going up is higher.

How difficult is the US retail industry now? We can see one thing or two from the following series of data:

On the one hand, the Financial Times quoted the analysis of US research institution Coresight as saying that as many as 630,000 retail stores in the United States were forced to close down under the influence of the national blockade policy.

Data from the American Retailers Association (NRF) show that US retail sales will drop by US$ 430 billion in the next three months.

On the other hand, so far, major retailers such as US Department Store, GAP, karl korsch Department Store and L Brands have announced large-scale layoffs or layoff plans.

Among them, 775 stores owned by Meisi Department Store have all been closed before the end of March. The epidemic has hit the US retail industry more than any previous crisis.

Only by changing the business model and other structural reforms can enterprises have the opportunity to overcome the current difficulties.

In addition, the Federal Reserve will also release a brown book report late at night, which can be described as an indicator of the Fed's future actions. Attention should be paid to whether its short-term bond issuance scale will expand, thus triggering asset market prices.

For detailed analysis and operation suggestions, please CLICK the following links to join the group and inquire with the administrator.

https://chat.whatsapp.com/Ippy9Pn5hjyEV7gtgCbVo0

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram