Oil Price Continues to Fall, Market Risk Mood Shocks

After Monday's sharp drop in oil prices, the June oil and spot oil also tumbled after yesterday's shift. Spot oil lost US$ 10 once again, triggering market panic.

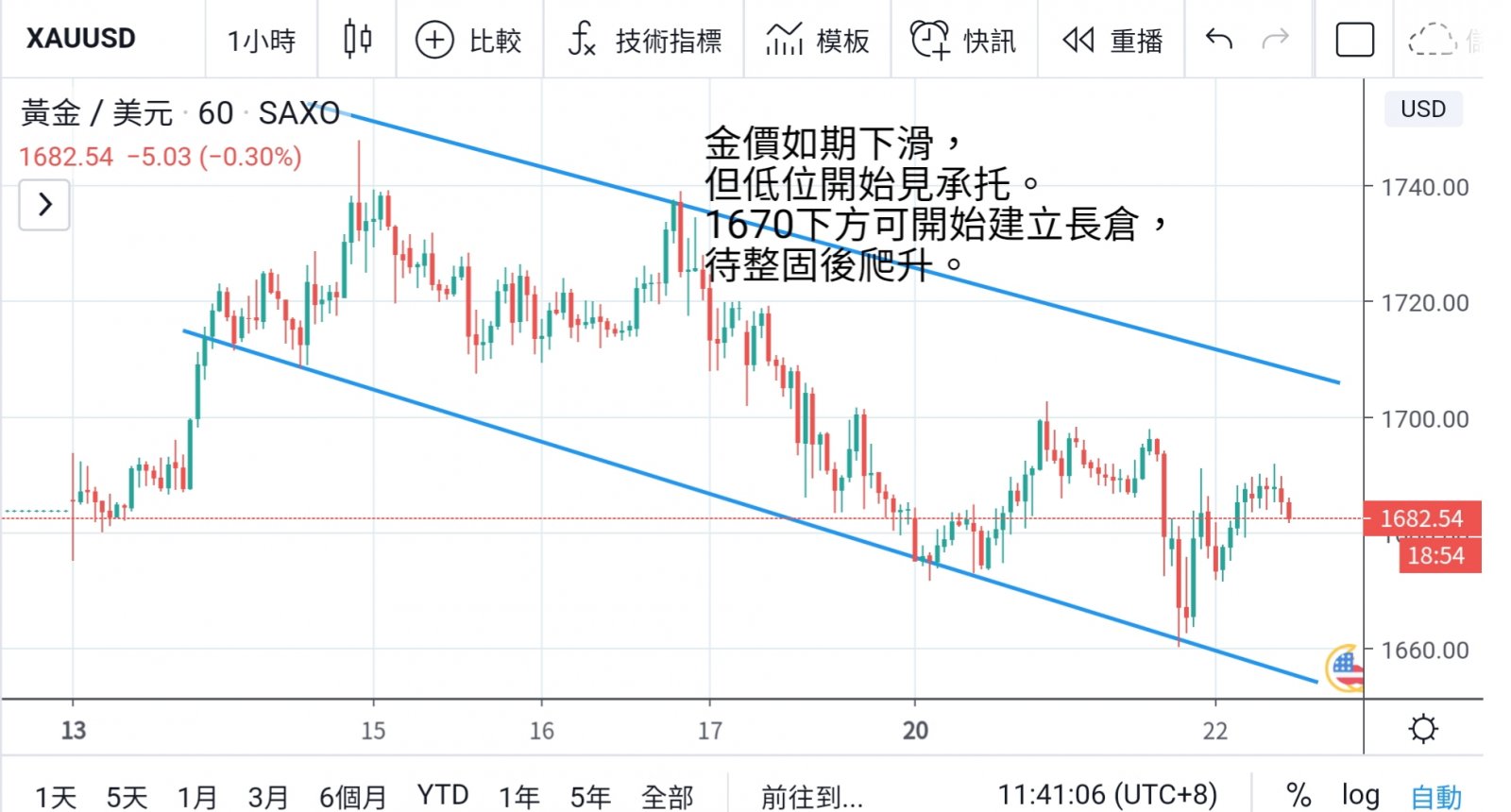

U.S. Dollar Becomes a Refuge of Funds, Supporting U.S. Foreign Exchange Weighted Index Staying Above 100. Gold prices moved repeatedly yesterday, dragged down by oil price panic.

Gold prices also eased back to the psychological level of 1660 for a while. If they were expected to do so earlier, they would have eased back to a lower level of 1660 with substantial support and a sharp rebound.

It can be seen that this level is worth absorbing in the medium and long term, but the rebound is restricted by the 1700 mark. Due to the rising risk factors, the market chose US dollar as a safe haven currency.

The rise of gold price is limited, and the short-term US dollar will remain stable. Therefore, it is difficult for gold price to rise sharply in real time. But the Bank of America issued a report,

Raising the gold price target from US$ 2,000 to US$ 3,000 per ounce shows that the market is still happy with the upturn in the future. Gold price is the market will be consolidated first, investors can bargain for it.

For detailed analysis and operation suggestions, please CLICK the following links to join the group and inquire with the administrator.

https://chat.whatsapp.com/Ippy9Pn5hjyEV7gtgCbVo0

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram