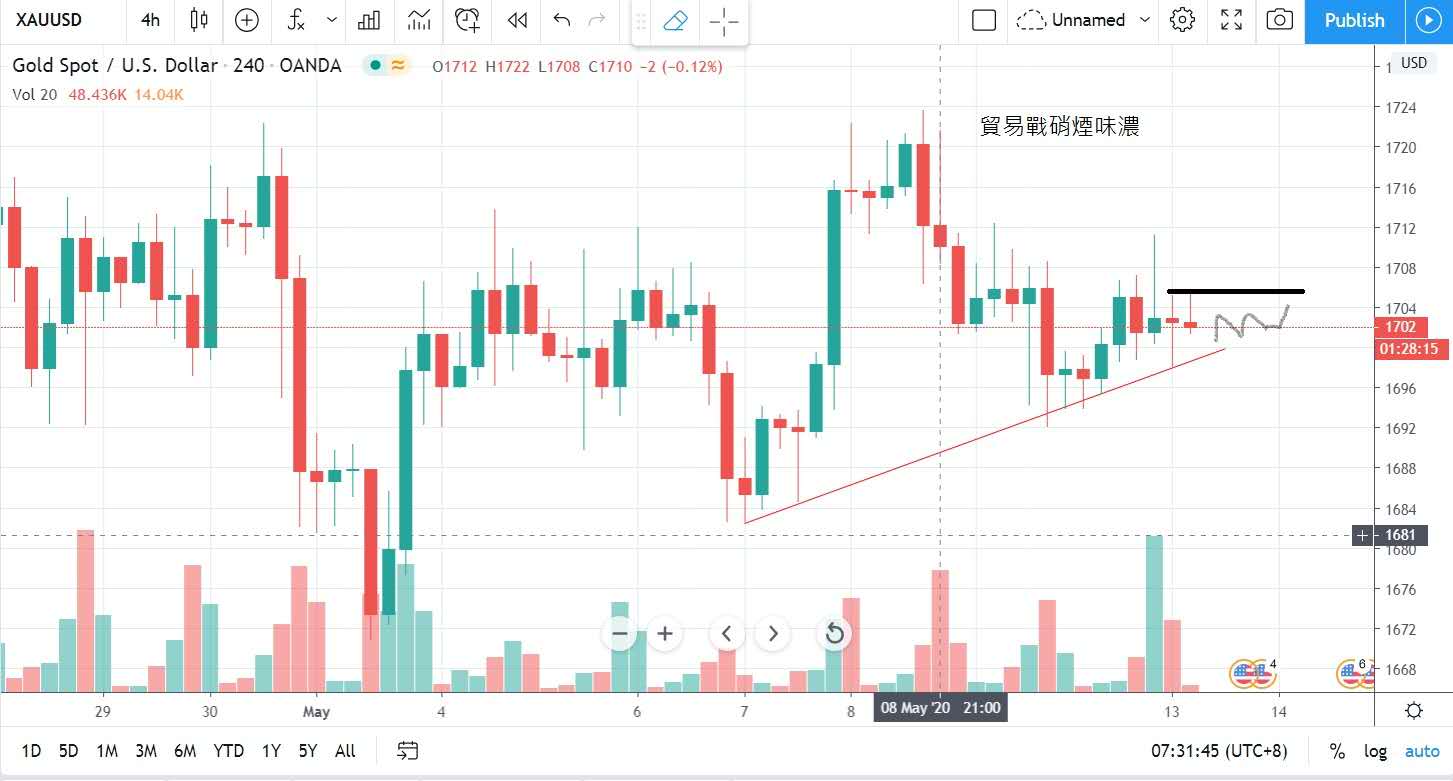

Trade War Rises

The trade war has resumed. Some Chinese officials are reported to be dissatisfied with the recent criticism of China by the United States over the newly crowned epidemic and with China's many concessions to the United States.

We are considering abolishing the existing first-stage trade agreement with the force majeure clause in the agreement and renegotiating the agreement that is more favorable to China.

China believes that the United States cannot restart the trade war in the election year and the current economic difficulties. It is in China's interest to renegotiate at this stage. Yesterday, China suddenly announced the exclusion list of goods subject to tariff increases on the United States.

It may be the first shot fired by China. Yesterday, four meat producers in Australia were banned from importing meat. Australia, as one of the five-eye alliance to monitor the epidemic situation in China, is also provocative.

In an interview, Williams, a former vice chairman of the U.S. Economic Commission and former U.S. President Trump, pointed out: Sino-U.S. tensions are rising due to the newly crowned epidemic.

Describing the two sides as having launched a new cold war, they also warned that if not handled carefully, things would become far worse than at present.

Before Federal Reserve Chairman Powell was about to make an economic speech, US President Trump was again pushing for the Federal Reserve to adopt negative interest rates, stressing that other countries were enjoying the benefits of negative interest rates.

The United States should also accept it. He also proposed to restrict the investment direction of the US Federal Reserve Fund, that is, not to buy Chinese investment products!

With the second wave of possible new virus attacks and the rise of trade wars, gold prices approached 1712 twice in US trading yesterday, returning to 1700 to consolidate and try to move up gradually.

After China restarted its economy, it has bought more crude oil and shipped it, while many countries in Britain, the United States and Europe have gradually relaxed social restrictions, and oil-producing countries have agreed to reduce production again, which is beneficial to oil prices.

In fact, the world cannot be shut down for a long time due to the epidemic. The demand for crude oil will continue to increase even if it cannot return to before the epidemic.

However, investors are observing crude oil stocks at this stage, and new york crude oil futures are vying to hold between US$ 25.50 a barrel.

For detailed analysis and operation suggestions, please CLICK the following links to join the group and inquire with the administrator.

https://chat.whatsapp.com/Ippy9Pn5hjyEV7gtgCbVo0

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram