Face the reality

European and American stock markets fell, and the market fell by 0.2-0.5%, while the three major indexes in the United States continued to be plagued by the epidemic. Investors worried about the performance of enterprises and reduced their holdings of risky stock assets; In reality, it is not an investor's worry.

The American Disney Group, which believes that adults bring a dream world and bring infinite joy to children, has just announced its results. It recorded a loss of 4.72 billion US dollars in the second quarter of 2019, the first quarterly loss since 2001.

Have to face the reality, Disney Group announced that it will lay off 28,000 employees in the theme park in the United States, accounting for 25% of the total number of employees in the park. There has been no progress in the business agreement between Britain and the European Union.

Although the EU intends to give in on certain conditions to avoid Britain leaving the EU without consultation, which will bring uncertainty to the EU economies, there are still differences between the two sides on Britain's "internal market law", but the EU-based concession,

Enough to support the exchange rate of euro and sterling.

The two major parties in the US Congress have the opportunity to return to the negotiating table to solve the long-delayed new round of American epidemic relief measures. US House Speaker Pelosi said that the Democratic Party will plan to launch a new $2.2 trillion stimulus proposal.

The scale is smaller than the $3 trillion proposal put forward earlier, but the figure is still much higher than that put forward by Republican leaders. However, the gap has narrowed, and the COVID-19 epidemic in the United States has shown signs of rebound, which is also beneficial for the two parties to return to the negotiating table and speed up the implementation of the plan.

Especially in increasing unemployment benefits and providing assistance to some enterprises with great influence, such as airlines, it is urgent to put out the fire. The euro and the pound strengthened against the US dollar, while the US dollar weakened due to the return of the epidemic relief measures to the negotiating table.

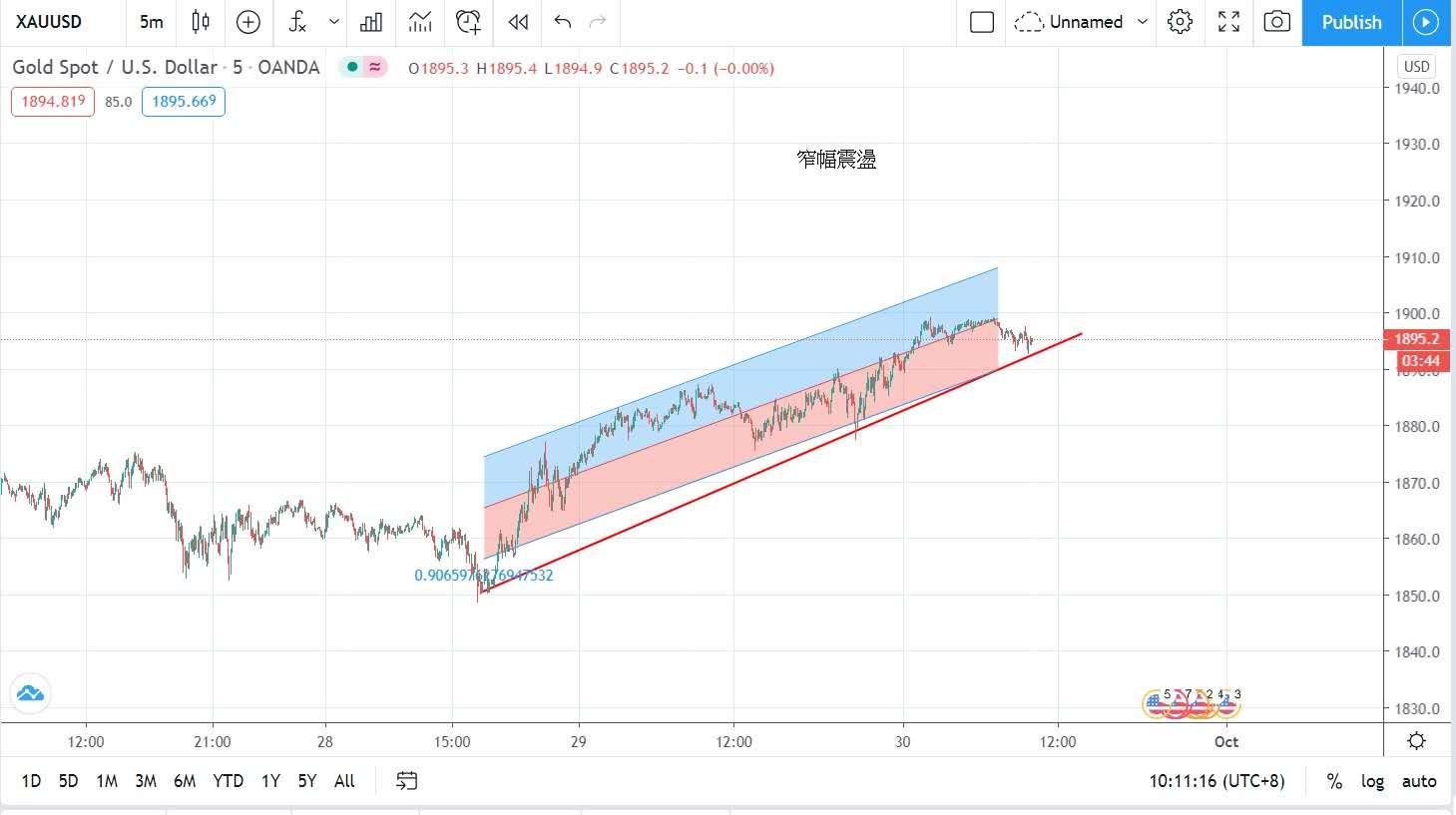

Coupled with the uncertainty brought about by the rebound of the US epidemic and the upcoming US presidential election, the US dollar index fell below 94 points yesterday and closed at the low of 91.81 points yesterday. Yesterday, gold prices benefited from the decline of the US dollar index again.

And investors adjusted their risk appetite for gold price. The price of gold went up and down yesterday and then rose. The lowest price was $1,875 per ounce, and yesterday it was $1,899 per ounce, and finally closed at $1,897 per ounce, up $16.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/joinchat/OEEaFRuyX_MDm6c8C1qbug

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram