Risk aversion is heating up

It has been ten days since the US presidential election voted. Although Biden, the US Democratic Party, claimed to have won the election, the counting of votes has not yet been completed. In Georgia, which has 16 electoral votes,

Trump, who lost only 14,000 votes in the initial counting, appealed for a recount, which was accepted by the local state government and announced to recount by hand. It is expected that the counting result will be completed on the 20th of this month.

But even if Trump can regain 16 electoral votes in Georgia, he is still far from the threshold of returning to the White House, unless he can overturn the election results in Michigan or Pennsylvania.

Otherwise, everyone can only lose a little better, and lose by a high vote. The day of voting by electoral votes is getting closer and closer, and the atmosphere of political instability is getting stronger and stronger.

Yesterday, the Hong Kong Health Bureau announced that there were 23 cases of new pneumonia in Hong Kong, of which 6 were local infections, but the source was unknown, and warned that a fourth wave of outbreaks might occur. Exhaustion continues to deteriorate,

There are nearly 1.3 million confirmed deaths worldwide, and the cumulative number of infected people in novel coronavirus is over 53 million. In the United States, there have been more than 100,000 patients for eight consecutive days. In Europe, Italy has also added millions of clubs.

It is the fifth European country after France, Russia, Spain and Britain, which has recorded more than 1 million new crown cases. The news of COVID-19 vaccine from Pfizer Pharmaceuticals and German Biotechnology was offset by the worsening fatigue.

Investors are worried that distant water can't save the near fire, and they are wary of the other market. In addition, European Central Bank President Lagarde made a discouraging statement. She said that although the vaccine news is encouraging,

However, it still faces the cycle of accelerating the spread of viruses and tightening restrictions on social measures. The investment climate in the risk market has deteriorated, major European stock markets have fallen across the board, and the German DAX index has fallen by 1.2%; French CAC index fell 1.5%;

The FTSE 100 Index also fell 0.7%.

In addition to the impact of the epidemic on the US stock market, it is reported that the White House has withdrawn from the coordinating role of the new epidemic relief plan, leaving the bill to the Senate majority leader, namely McConnell of the Republican Party, and the Speaker of the US House of Representatives, namely Pelosi of the Democratic Party, to continue to discuss.

To know that the difference between the two parties in the amount of aid is 1.9 trillion US dollars, investors speculate that the plan will not be launched this year, which will increase the risk aversion. Although the number of people claiming unemployment benefits for the first time in the United States last week announced yesterday was better than expected,

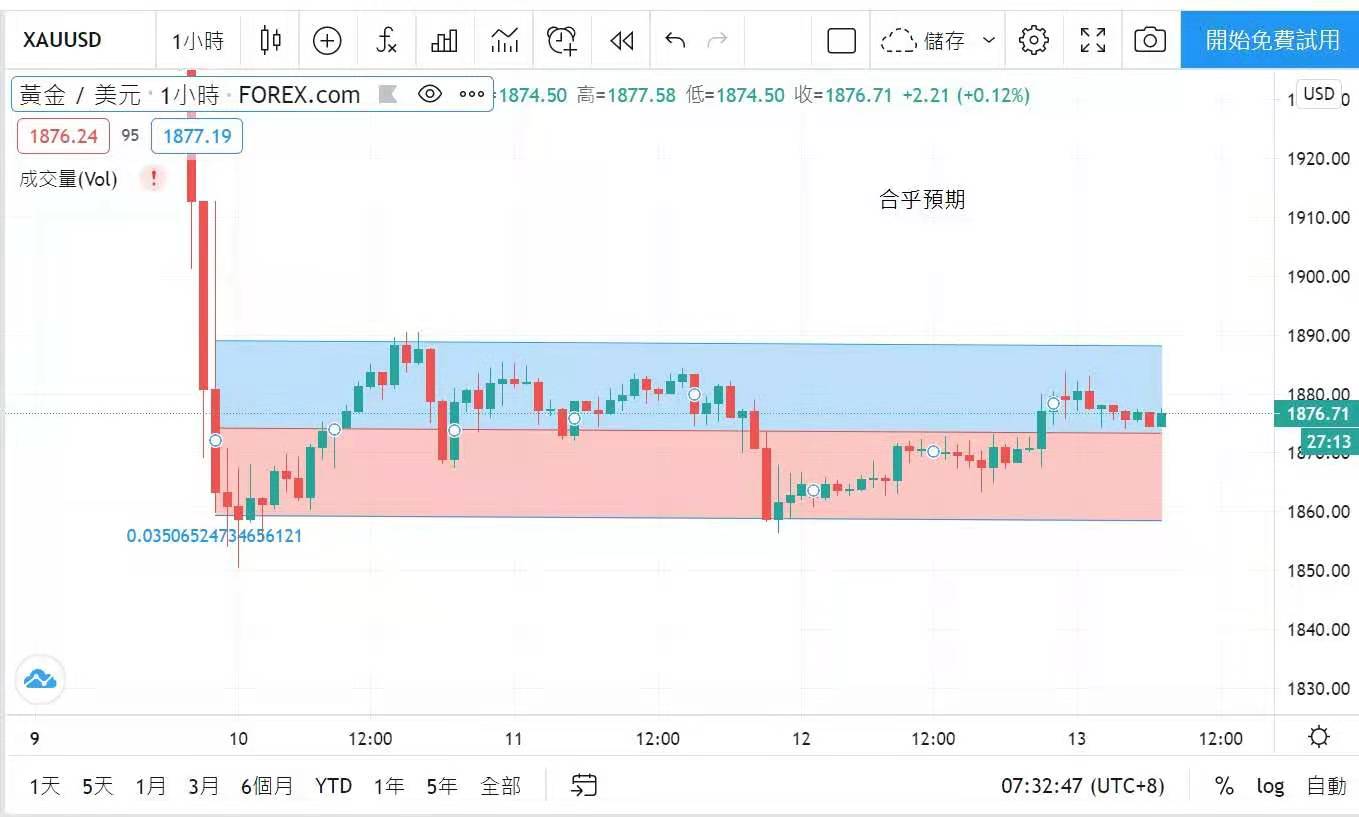

However, it was unable to prevent the overall decline of the new york stock market, and the Dow Jones index fell by 1.1%; The Standard & Poor's 500 Index fell 1%; Nasdaq index rose and fell 0.7%. Risk aversion warmed up, and gold prices rose yesterday.

The highest price of gold is $1,883 per ounce, the lowest price is $1,863 per ounce, and the final closing price is $1,877 per ounce, up by $12. It is expected that the price of gold will consolidate within this range before the US president announces his inauguration.

Bitcoin rose above $16,000 per piece yesterday, rising 3%, making it another safe-haven option for investors.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/joinchat/OEEaFRuyX_MDm6c8C1qbug

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram