A footstep away

Today's volatility range:

Gold retaliated yesterday. The new U.S. Treasury Secretary showed doves during his tenure as chairman of the Federal Reserve Board. It is expected that there may be a larger post-epidemic economic stimulus plan after taking office successfully.

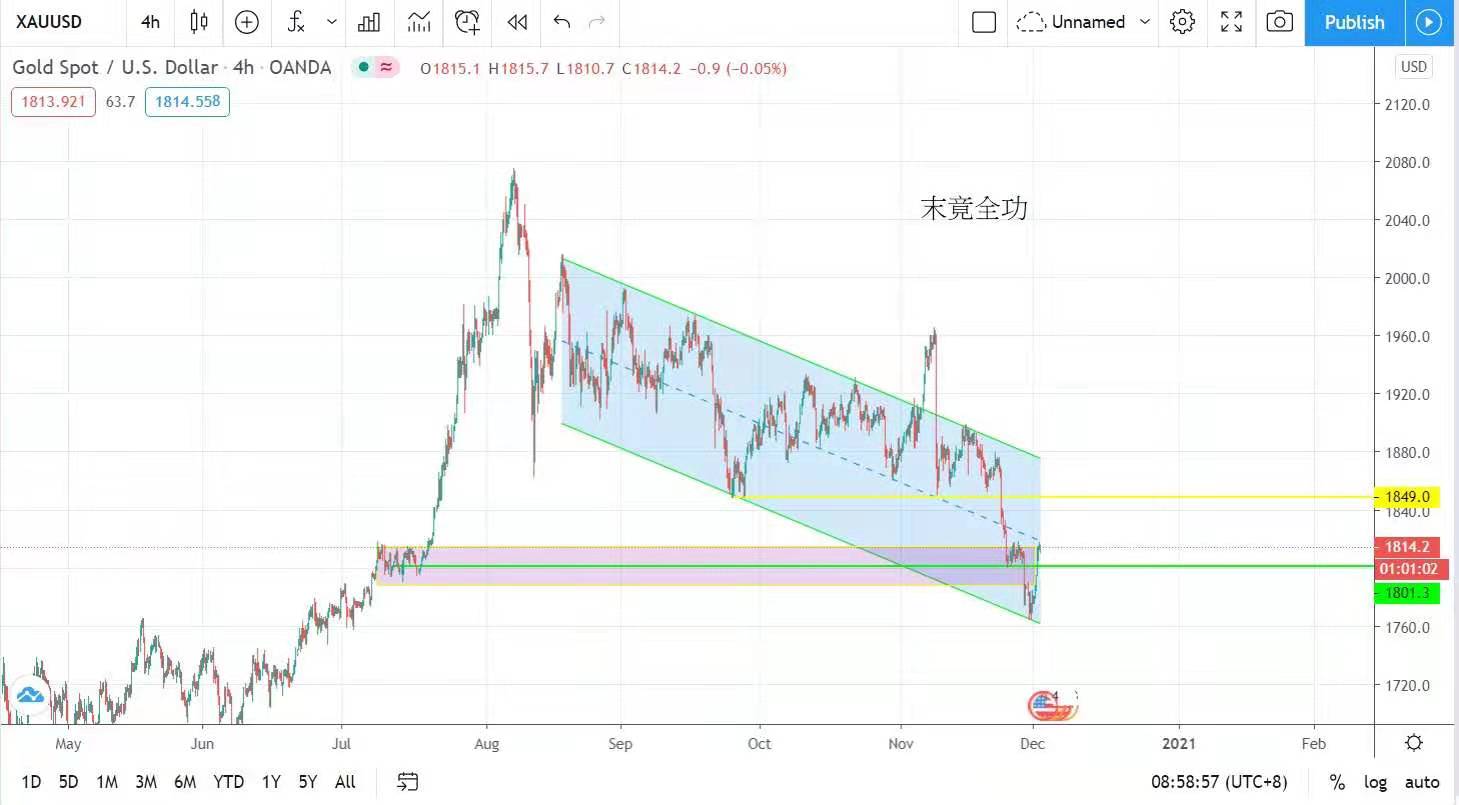

By then, the gold price will have a better understanding of resisting inflation and currency depreciation. Today's major volatility is 1805-1830 USD.

After the Federal Reserve Bank of Australia lowered the central bank's interest rate to 0.1% in October, it announced again yesterday that the interest rate will remain unchanged at 0.1%. Australian Federal Reserve Bank Chairman Lowe said yesterday that Australia is overcoming the economic blow brought by the COVID-19 outbreak.

The goal is to bring inflation back to the 2%-3% set by the RBA last month, and expect a substantial increase in wage growth. In order to revitalize the economy, the Federal Reserve Bank of Australia not only cut the central bank interest rate,

He participated in the quantitative easing policy for the first time and tried to support the economy by directly purchasing government bonds. In November, he completed the purchase of more than 60 billion US dollars of state government bonds and just started to purchase more government bonds as much as 100 billion US dollars.

And provided a credit line of up to 200 billion U.S. dollars to the country's commercial banks, with a view to lending the cash to small and medium-sized enterprises. Lowe pointed out that the Federal Reserve Bank of Australia does not expect to change the interest rate setting until 2024, implying that it has no intention of implementing negative interest rate policy.

Australia's economic system is inferior to that of the United States, but the challenges facing the economic prospects are the same. Whether the actions of the Reserve Bank of Australia can serve as a reference for investors as the Federal Reserve will be announced in mid-December. At present, however, it is more likely that American financial officials tend to be doves.

Federal Reserve Chairman Powell disclosed in his preparatory speech to the Senate Finance Committee yesterday that the slow recovery of the United States and the rebound of the new pneumonia epidemic mean that the United States will be challenging in the next few months, indicating that economic growth and the job market have rebounded significantly since the second quarter.

But many Americans are still in trouble. Also present with Powell was the current U.S. Treasury Secretary Mitchin, who said in his testimony that he strongly urged Congress to use the unused $455 billion in the Economic Relief Act.

To pass another bill supported by both parties, and to show that the government is ready to support Congress to help workers and small and medium-sized enterprises that continue to be affected by the epidemic.

In addition, Yellen, the former chairman of the Federal Reserve Board, has been confirmed to be appointed as the new US Treasury Secretary by Biden, the winner of the US general election. She said that she will do her best to benefit all Americans after taking up her new job. Yellen was a dove during her tenure as chairman of the Federal Reserve Board.

Has been calling on the government to increase fiscal expenditure to promote economic recovery, which is similar to the idea of the Democratic Party of the United States. It is expected that after taking office successfully, a larger post-epidemic economic stimulus plan may be launched.

Stimulated by the good news that the vaccine will be distributed soon, the European and American stock markets did a good job yesterday, and the German DAX index rose by 0.69%; French CAC index rose by 1.14%; The FTSE 100 Index rose 1.69%. The three major indexes of new york stock market all reached new highs in yesterday's trading session.

Dow Jones index rose 063%; The Standard & Poor's 500 Index fell 1.13%; Nasdaq index rose 1.68%.

The news of vaccines came out one after another, and the election results became clear gradually, but the US dollar epidemic was weak, and the US dollar index hit a three-week low, closing at 91.18 points. Gold rebounded retaliated yesterday, and the price of gold rose when it opened yesterday.

The highest rose to $1817 per ounce, and closed at $1815 per ounce, rising by $38.

Bitcoin rose to US$ 19,910 per piece yesterday, reaching a record high, but for investors aiming at 20,000 yuan, it can be described as a step away, but it was all successful at the end! Close at about 19110 each.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/joinchat/UHHKFlQVzTCbjfPiBKIOPQ

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram