Gold investment demand

January 29 th

Today's volatility range:

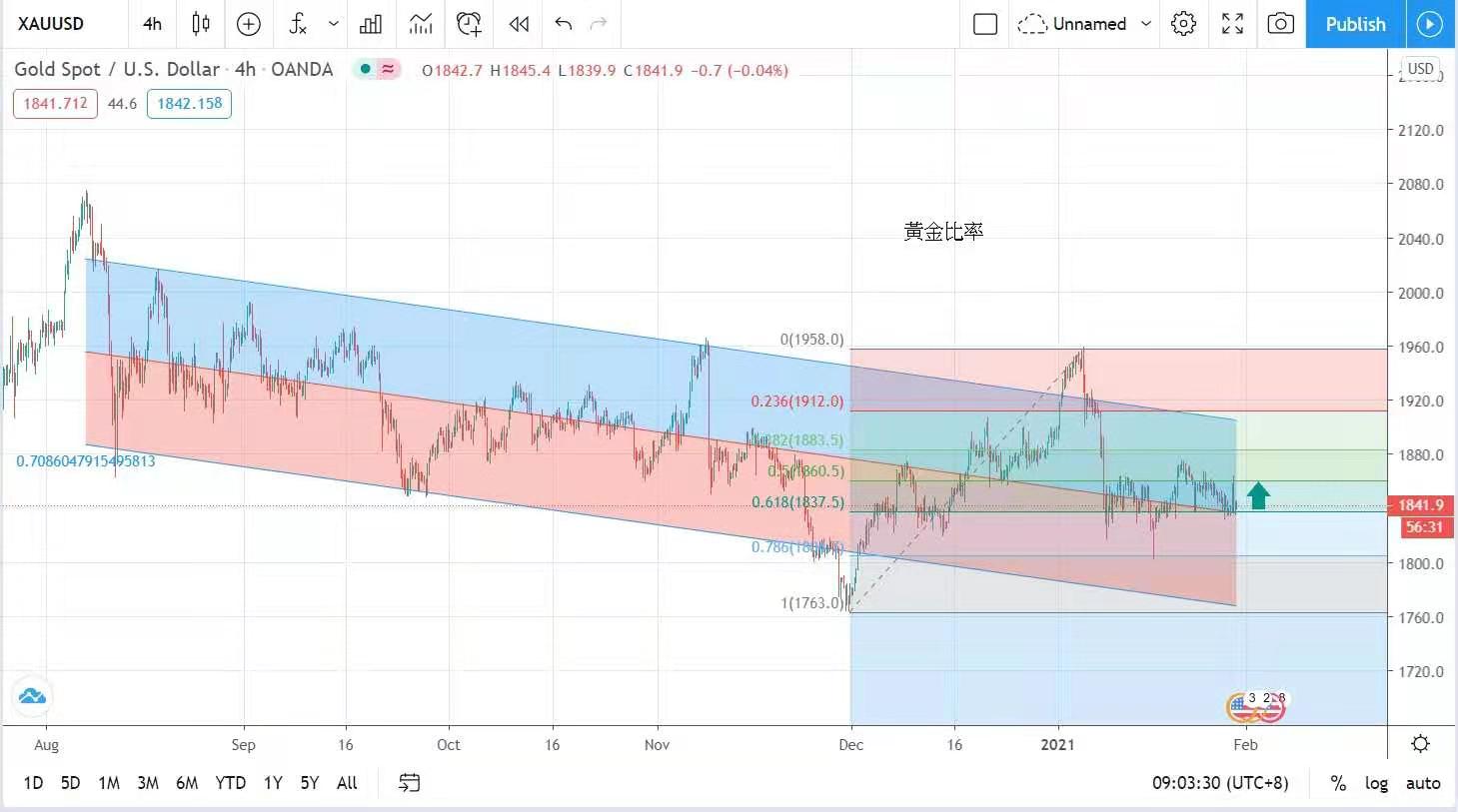

The price of gold fluctuated greatly in the US market last night, but it was obviously still subject to the resistance level of $1,864 per ounce, and it is expected that it will still go up and down today. It is suggested that today's volatility should be between 1835 and 1853 dollars.

Prime Minister Johnson visited COVID-19 patients in Scottish hospitals yesterday, and "incidentally" called on Scots not to hold a referendum to leave the UK, apparently worried that Britain's split would deal a heavy blow to Britain's image.

And extend to the economy and the future of the pound. Britain's FTSE 100 index fell by 0.63%. Earlier, European Central Bank President Lagarde spoke many times and mentioned that the European Central Bank will closely monitor the euro exchange rate.

Followed by the European Central Bank Management Committee member and the Dutch central bank governor, Crash Hanguz said that the central bank has tools including interest rate cuts to prevent further appreciation of the euro.

Yesterday, another Committee member opposed the opposite view, saying that the European Central Bank has other tools to use, such as buying bank bonds and putting emergency aid funds in appropriate investments.

It can still stimulate inflation moderately. Major stock markets in the euro zone rose, and the German DAX index rose by 0.33%; French CAC index rose by 0.93%.

The data is convenient. Last night, the fourth quarter GDP of the United States increased by 4% quarter, in line with market expectations; However, in 2020, U.S. GDP declined by 3.5%, which was the first negative growth since 2009.

Set a new low since 1946. In the United States, the number of people applying for unemployment benefits for the first time last week was 847,000, which was better than the market expectation, but the number still did not return to the average in the second half of last year, indicating that the epidemic still plagued the labor market.

The three major indexes of the new york stock market rebounded yesterday after falling sharply the day before yesterday, and the Dow Jones index rose by 0.99%; The Standard & Poor's Index rose by 0.98%, while the Nasdaq Index rose by 0.5%. The Gold Association published a report,

Last year, global gold consumption demand dropped by 14% to 3.76 thousand tons compared with the previous year, which was the first time since 2009 that it was lower than 4 thousand tons. The demand for gold ornaments dropped obviously, which was obviously hit by the epidemic. The global economy shrank severely last year.

On the other hand, the price of gold has been rising in the past year due to the demand for safe haven, and it has reached a record high. In addition, India and China, the two countries with the greatest demand for gold ornaments in the world, often need gold ornaments during marriage.

However, consumers all over the world are restricted by the epidemic blockade, and wedding ceremonies are still restricted. Brides have to accept simpler ceremonies, which greatly undermines consumer desire.

The report shows that India's demand fell by more than one-third to 446 tons last year.

Create a new low after 1994; In the first quarter of 2020, China's demand for gold ornaments has dropped by 65% year-on-year, which is staggering! Contrary to consumption of gold, the demand for investment in gold market has increased obviously.

Due to the increase in political uncertainty and conservative policies under the epidemic, the demand for gold investment has been greatly increased, rising by 40% year-on-year to a record 1.77 thousand tons; Global gold exchange-traded funds increased their holdings of 877 tons of gold by a record last year.

Last night, investors focused on the negative growth of U.S. GDP recorded last year. The U.S. dollar fell sharply, and the price of gold rose sharply in a short time, from the lowest of 1,835 dollars per ounce last night to the highest of 1,864 dollars per ounce.

However, due to the rising yield of US Treasury bonds, it turned to fall, and finally closed at 1843 US dollars per ounce, with a slight loss of 1 US dollar for the whole day.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/mingtakchat

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram