Manufacturing slows down

August 3 rd

Today's volatility range:

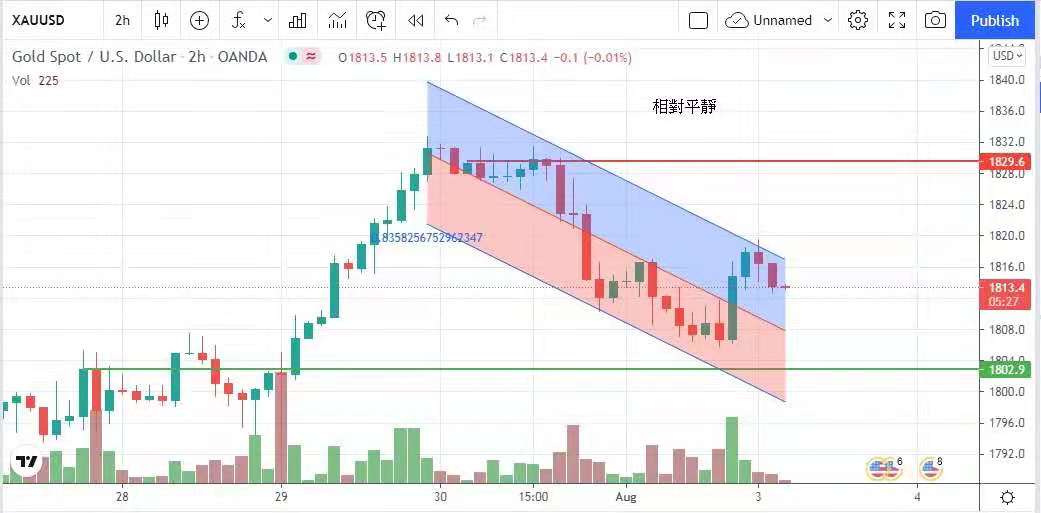

Gold prices fell when the market opened, but the expansion of American manufacturing industry slowed down, and the yield of US dollar index and US 10-year treasury bonds fell, which helped the gold market rebound. Gold prices closed flat yesterday. The price of gold exceeded $1,800 last week

Psychological barrier, but obviously there is resistance at $1830. Although the volatility reached $14 yesterday, the market situation was relatively calm, reflecting that investors are watching the non-agricultural data of the United States this week.

Maintain yesterday's suggested volatility between 1809 and 1822.

The purchasing managers' index of mainland manufacturing industry fell from last month to 50.3, which was lower than market expectation and the lowest level since April last year. Some scholars said that due to the uncertainty of the global epidemic, China, as a global factory,

With the decrease of orders and the shortage of supply chain, the compressed order index fell to 49.2 and fell into the contraction area below 50; The growth rate of domestic demand has also slowed down, and the rebound of the mainland manufacturing cycle has reached a high level. It is expected that the mainland purchasing manager will

The index will continue to slow down in the future. The mainland economy slowed down and Beishui continued its net outflow, but the Hong Kong stock market rose unimpeded. HSBC announced its performance yesterday, which exceeded market expectations. The stock price once rose by 4% at most, and the closing increase narrowed to nearly 1%.

However, it was enough to benefit the market atmosphere, and the Hang Seng Index rose by 274 points or 1.06%, regaining the level of 26,000.

The European manufacturing industry or data released yesterday is ideal. The final value of the manufacturing purchasing managers' index of the euro zone in July is 62.8, which is higher than the expected value and 62.6 in the previous June. A record high; Coupled with the satisfactory performance of many companies, the three major European countries

The stock market rose across the board, and the German DAX index rose by 0.34%; The CAC index in Paris, France rose by 0.97%; The FTSE 100 Index rose 0.90%. Looking forward to the U.S. infrastructure bill will bring more fiscal stimulus, the U.S. stock market did a good job in early Monday.

However, the institute for supply management Manufacturing Purchasing Managers Index unexpectedly fell, and the three major indexes on Wall Street closed individually, and the Dow Jones index fell 0.28%; The S&P 500 index fell by 0.19%; Nasdaq index rose 0.06% to close.

The price of gold fell when the market opened, but the expansion rate of the US manufacturing industry slowed down. The US dollar index once fell below the 92-point level, and the yield of the US 10-year government bond also fell to 1.18%. Both of them were conducive to the rebound of the gold market. The price of gold closed flat yesterday.

$1814, with the highest and lowest prices being $1820 and $1806, respectively.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/mingtakchat

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram