Gold and the dollar are on track to strengthen this week's trend is expected to continue

The dollar strengthened against gold last week, as expected, as investors shrugged off concerns about pneumonia in wuhan, and U.S. economic data was generally positive.

Stimulus money flowed into asset markets such as the U.S. dollar and U.S. stocks. On the other hand, investors were also happy to hold on to gold.

In a global environment of low interest rates, the cost of holding gold is fairly modest, with the medium to long-term support for gold, which is approaching the 1,600 mark again and has a chance of hitting a near seven-year high if it breaks through again.

US President Donald trump has repeatedly called on the federal reserve to loosen monetary policy after the central bank released a record of last month's rate hike in the middle of a week that has seen few economic data.

While the fed did not cut rates last month, the market is also looking forward to the possibility of a rate cut this year.

Monday is a holiday for the President of the United States, and it is believed that the market will be less volatile during the early part of the week.

The dollar has been strong for the past week, with all three major U.S. stock indexes continuing to hit new highs on the back of recent good economic data, and the dollar in favor, with the U.S. weighted index climbing above the 99 level.

The euro has fallen to a three-year low of 1.08; U.S. economic data was good, but the euro zone economy held up, and investors were even more worried that the European central bank was about to launch another round of stimulus measures to rescue the economy.

Shift, the euro is still at stake, this week could further 淜 under 1.07 level, the hui weighted index will be strong to challenge 100 mark.

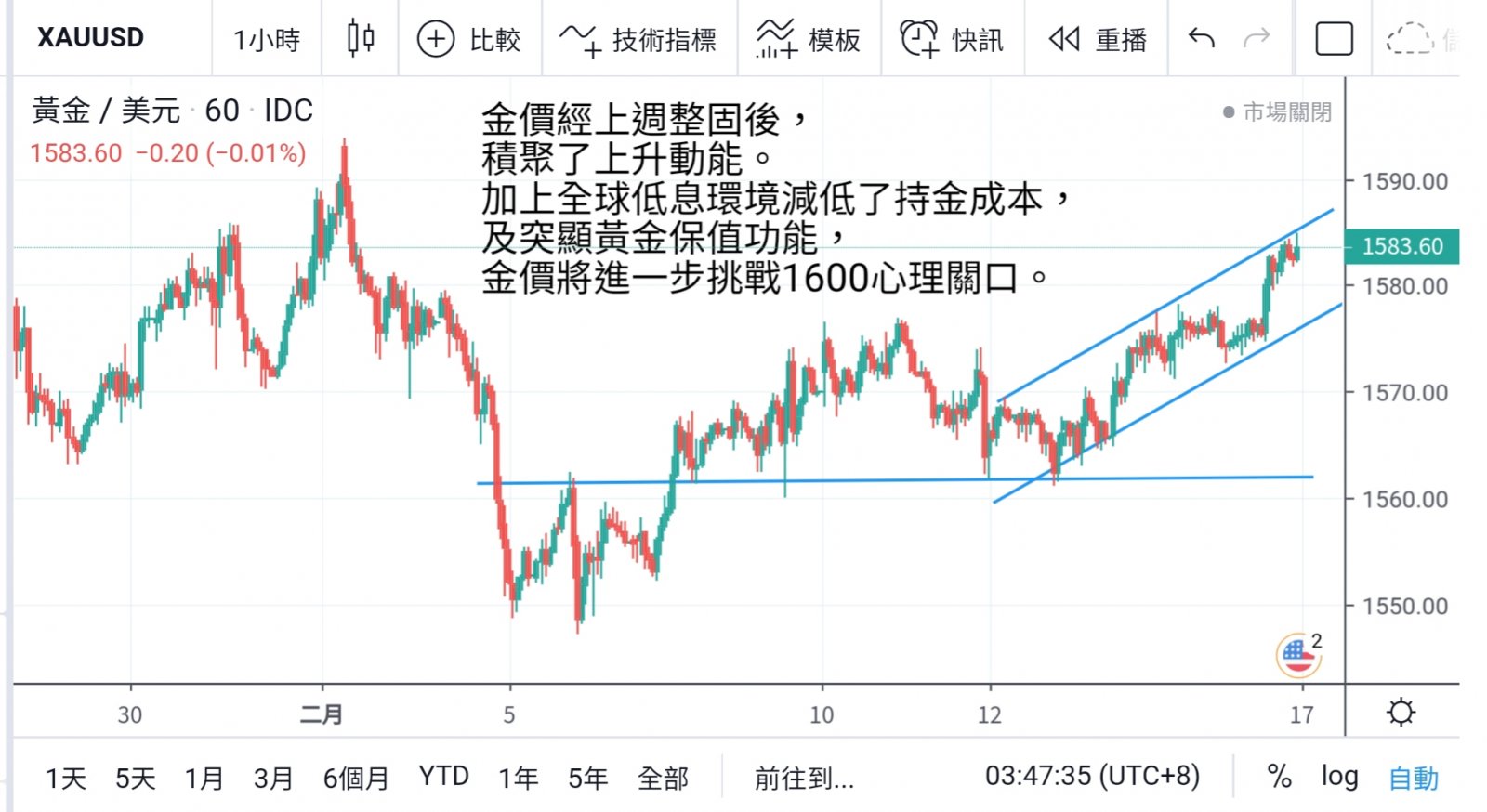

But despite a stronger dollar, enthusiasm for gold has not waned. Gold has found support below 1550 after seeing a slight pullback in the early part of last week, with a surge of buying sending prices to their highest close of the week.

Technical trends are quite consistent. In addition to the federal reserve, which will keep interest rates low this year, the market is hoping that the European central bank, the bank of England, the reserve bank of Australia and even the people's bank of China will cut interest rates to stimulate the economy or issue more debt.

These expectations of market liquidity have supported the medium-term rally in gold prices by reducing the cost to gold holders, reducing the purchasing power of silver paper and highlighting the value of gold as a store of value.

Technically, after last week's first drop followed by a rise, gold prices are on the verge of breaking through and stabilizing above 1580 this week. With the momentum accumulated last week, gold prices are expected to hit the psychological level of $1600 at one blow.

Investors can follow suit. While Monday is the U.S. President's day holiday, the U.S. market will be closed. For the first time, trading volume will be relatively sparse and calm.

Note whether the record will release pigeons to support the gold price upward breakout.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram