Trump's Trillion Market Rescuers Improve Market Atmosphere

The United States continues to resort to rescue the market. In addition to implementing monetary policy, Washington has also launched a fiscal policy to rescue the market. US President Trump directly sends money to US citizens, stimulated by news.

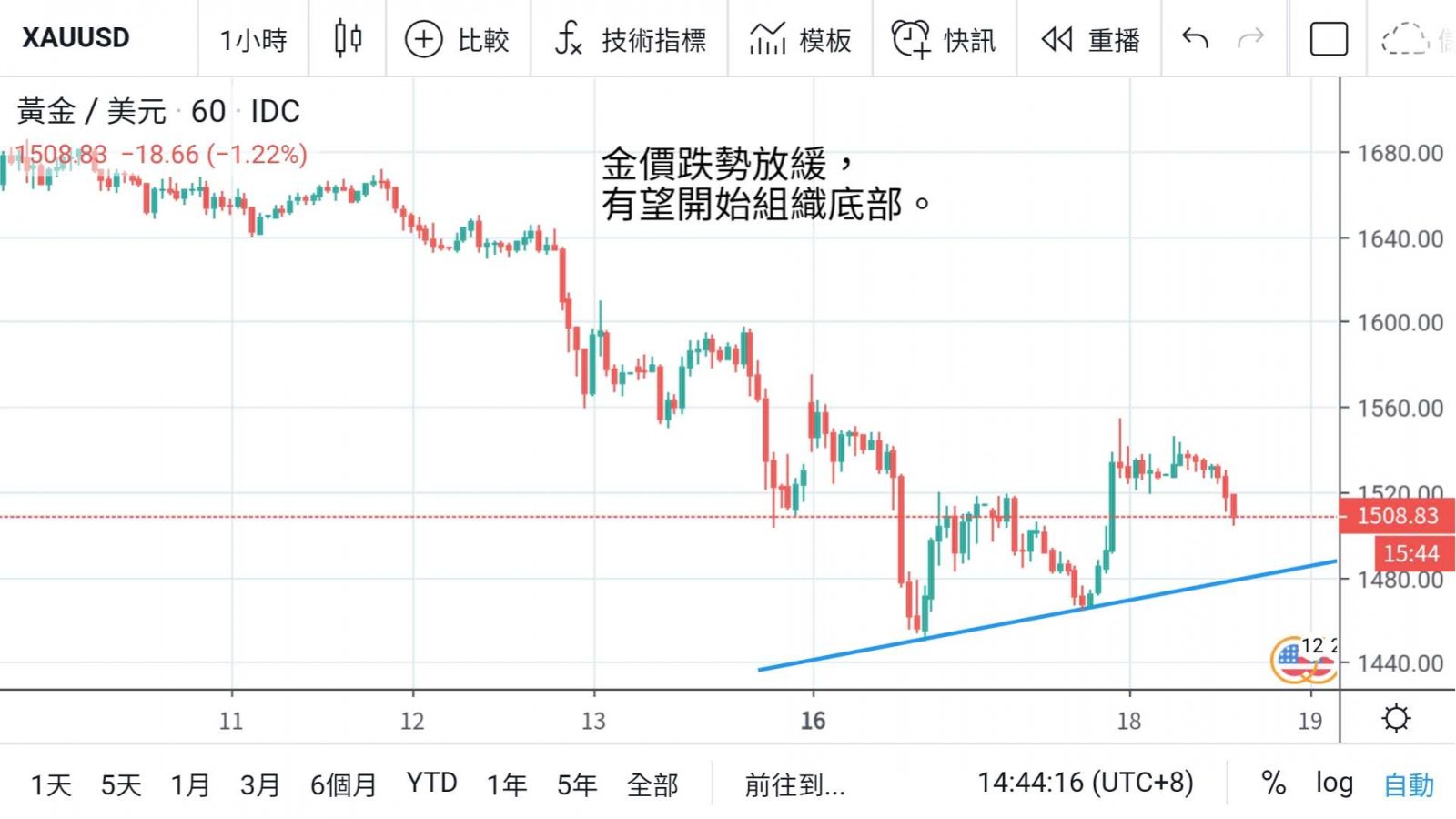

Coupled with the support of U.S. stocks in buying technology before the 20,000 mark, U.S. stocks led the global stock market to rebound sharply. Gold prices also rebounded sharply from the low due to the easing of the capital chain.

The short-term low has been seen, but the recent volatility is relatively large. Gold prices can only buy up at bargain prices and enter the market conservatively. With measures taken by various countries coming out one after another, we are now waiting for the epidemic to subside.

Financial market confidence will gradually return to stability and market turbulence will be reduced. There are a number of economic data released tonight in the United States. However, due to the lagging data, it is not able to reflect the situation and its insufficient importance, it is expected to have a limited impact on the immediate market response.

In addition to the tax exemption plan to be launched earlier, the United States has launched a trillion-dollar economic plan to rescue the market, directly distribute money to bank accounts of American citizens, and will give enterprises up to 10 million dollars.

The US Treasury Secretary confirmed that Trump would approve a total of 300 billion US dollars in deferred tax payments for individuals up to one million US dollars.

The new york District Federal Reserve also continued to maintain market stability. This week, it provided US$ 1 trillion in funds every day through buybacks to ensure that US stocks rebounded sharply with a large margin of capital flow.

The U.S. dollar is also improving, but with the support of real buying at the low level in the gold market, it did not try a new low again, but rebounded sharply and stabilized the 1,500 U.S. dollar mark again.

After falling back from US$ 1700, the gold market has fallen by more than US$ 200. During the week, it saw that the 1450 mark was supported by real buying. This level is expected to become the mid-term bottom. After organizing the bottom, it will rebound step by step.

Countries have been releasing water continuously recently, and the stock market has also dropped to a more critical level. Although the epidemic situation has not improved immediately, I believe it will eventually remain under control, just like the epidemic situation in China and Hong Kong. However, after the monetary policy is released,

However, it will not be tightened immediately at any time. I believe there will be a honeymoon period in the market. As long as the epidemic situation starts to improve, there will be too much hot money in the market. As asset prices are pushed up, QE in various countries will also highlight the ability of gold to maintain its value.

Gold prices are now rising above US$ 1,500, but the trend is still relatively volatile, continuing to bottom at 1,450, buying at bargain prices and waiting for market conditions to stabilize.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram