Gold Price Continues to Reach New High in Recession

The poor economic figures released by the United States cite the recession that has supported the rise of gold. However, some people are happy and others are worried. Oil prices are affected by the epidemic.

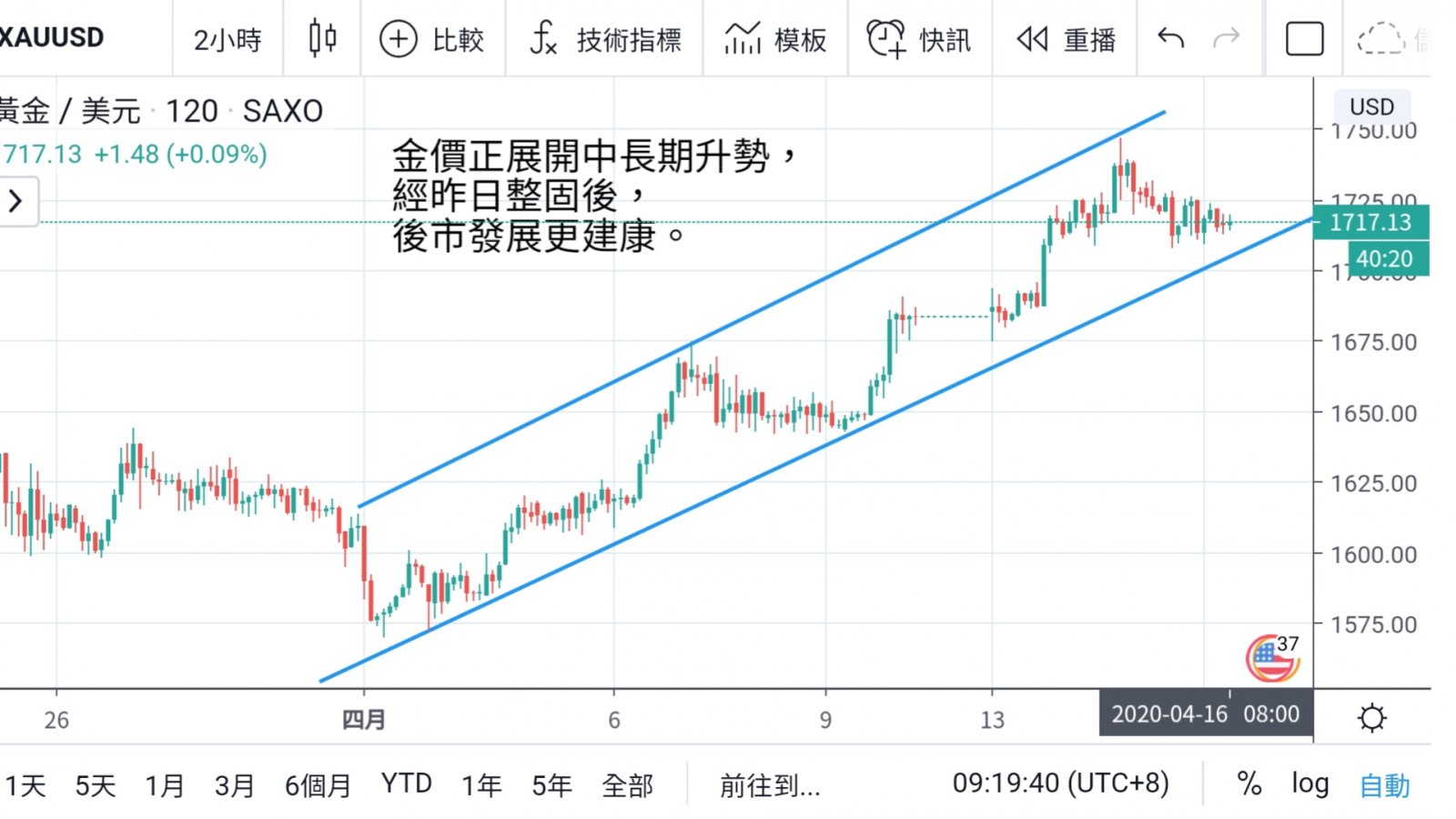

Demand has fallen sharply, oil stocks have exploded and oil prices have fallen to a nearly 20-year low. Gold prices were adjusted in the early Asian market period, but they soon regained their upward trend.

U.S. retail sales plunged 8.7%, worse than expected. new york's manufacturing index fell further to -78.2, a record low.

The U.S. economy is shrinking across the board. Late at night, the Federal Reserve's Brown Book pointed out that economic activity in all regions of the United States has dropped sharply due to the new crown pneumonia.

The employment population has declined, among which retail, tourism and leisure, as well as hotel industry have been hit hardest, and layoffs have also begun to occur.

Federal Reserve in all parts of the world said that commercial contracts faced extremely high uncertainty.

Gold prices are gradually stabilizing, but oil prices are declining due to a sharp drop in demand. Global oil demand will plummet 9% this year, the biggest drop on record. OPEC+ production cuts cannot make up for the drop in demand.

The IEA is even more alarmed by the excess supply of crude oil, saying that oil reserves will probably explode in the next few weeks. During the new york period, oil prices even lost US$ 20, a nearly 20-year low.

Tonight, the United States will announce the number of first-time jobless claims in a week and the Philadelphia Federal Reserve's manufacturing index. It is expected that the epidemic will continue to affect the market and demand for safe haven will remain strong.

For detailed analysis and operation suggestions, please CLICK the following links to join the group and inquire with the administrator.

https://chat.whatsapp.com/Ippy9Pn5hjyEV7gtgCbVo0

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram