Debt inversion is expected to succeed. Last seven recessions

Recently, the most explosive discussion in the market must be the debt-interest inversion. Do you know it?

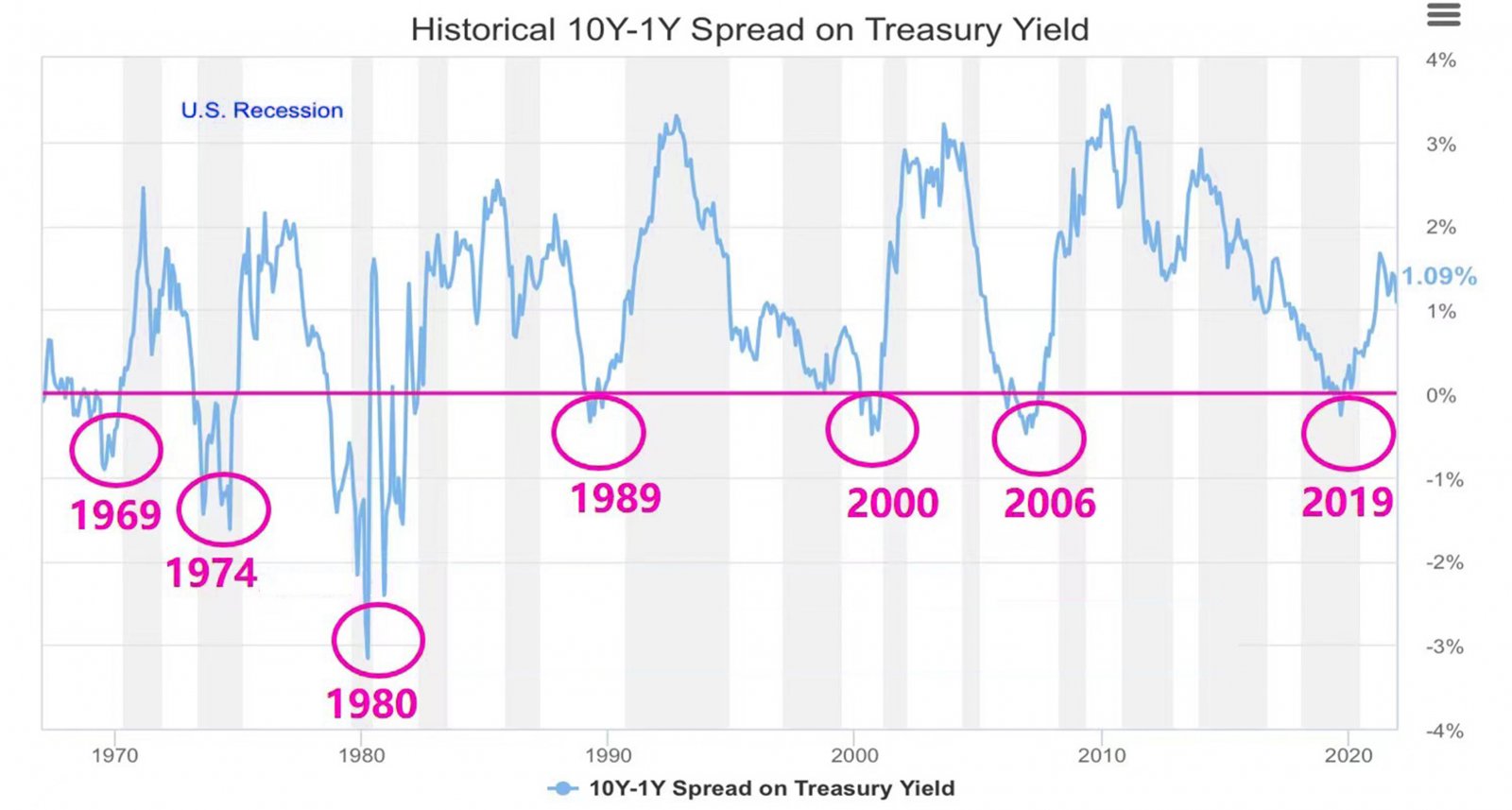

Debt interest inversion, that is, the short-term debt interest rate is higher than the long-term debt interest rate, is regarded by the market as a harbinger of economic recession. In the past 50 years, almost every time before the economic recession in the United States, the debt interest rate fell.

Generally, 1-year debt is used as short debt, and 10-year debt is compared with long debt. However, is it economic recession to solve the problem that short debt has high interest rate and long debt rate?

With a normal development, the future price and interest rate of the economy will be higher, the economy will grow, inflation will rise moderately, interest rate will gradually increase, cost and expenditure will rise, and asset returns will be achieved.

The rate will also rise at the same time, because the short-term interest rate must be lower than the long-term interest rate under the optimistic expectation of economic growth. But when the short-term debt interest rate is higher than the long-term debt interest rate, it means that the situation has just reversed.

No longer optimistic about the future prospects of the market, capital flows into long-term debt to hedge against risks, which lowers the long-term debt interest rate, thus leading to the "inversion of the yield curve". In the past, the inversion of long-term debt interest rate and short-term debt interest rate was perfectly accurate.

To predict the economic recession, knowledge is related to debt and interest, and the next time the economy is in that cycle, it will be easier to make a judgment.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram