新方向

March 29 th

Today's volatility range:

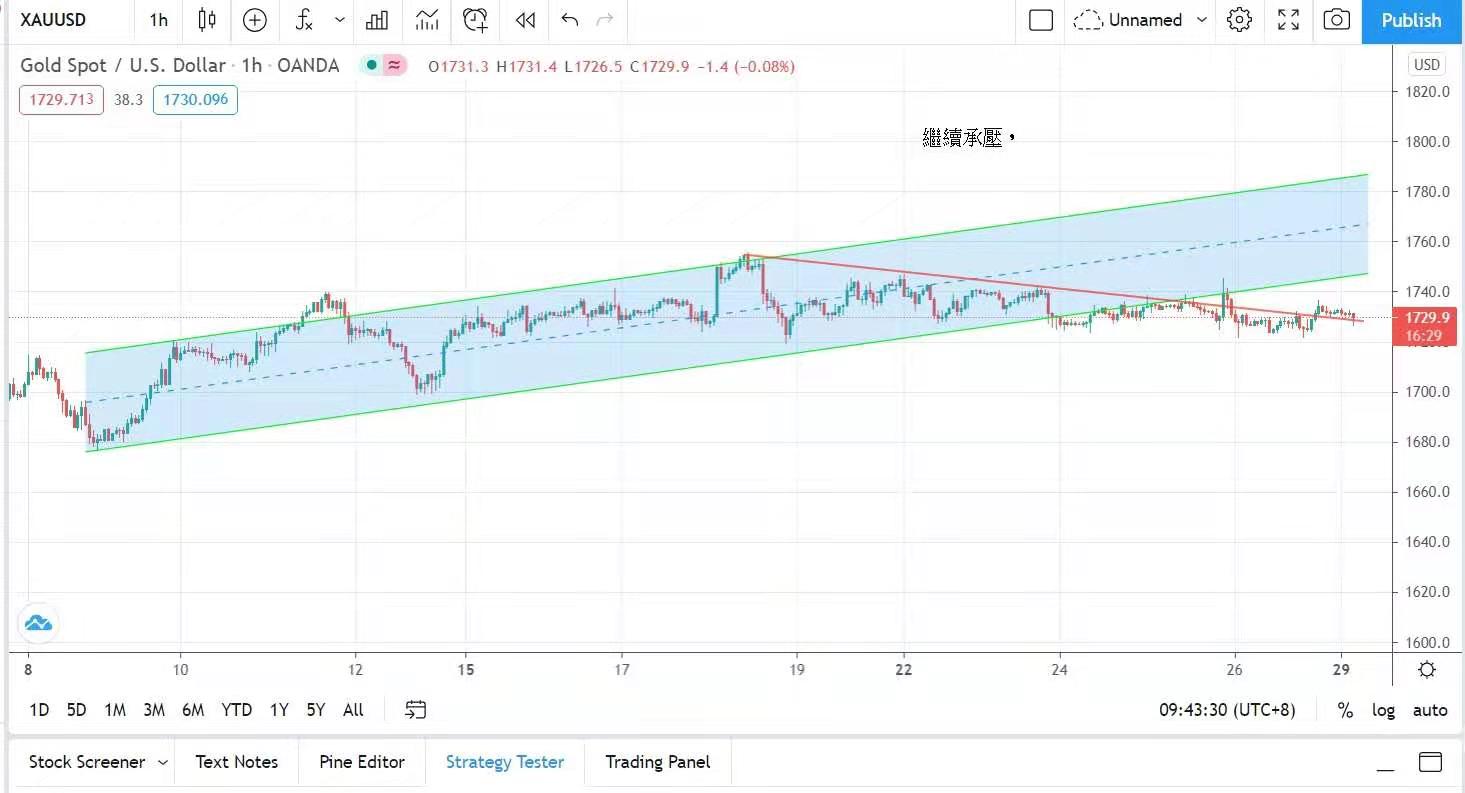

The trend of gold price is still subject to the downward pressure line. Recently, the yield of US Treasury bonds has not affected the gold price. On the contrary, the gold price is sensitive to the strength of the US dollar, and the economic data is improving.

Stimulating the US dollar to be sought after, the price of gold will continue to be under pressure. There are non-agricultural employment data this week, and the price of gold has been consolidating for two weeks from 1720 to 1740. After the data is released, it can indicate a new direction.

Today, the proposed amplitude is between 1720 and 1738.

International concern about China's democracy has extended to the cotton mainly produced in Xinjiang. Some international fashion brands have announced in a high-profile manner that they will follow the purpose of the Good Cotton Development Association (BCI).

No longer purchasing new and strong cotton, the incident aroused the reaction of Chinese netizens, and a large number of Hong Kong and Taiwan stars also terminated their contracts with "insulting enterprises". Some citizens said that they would stop buying and buying these enterprise brands

Products and batch enterprises will be kicked out of the Chinese market. There are also fierce citizens who burn a brand of sneakers live on the Internet. Some stores are closed for one day for fear of being damaged, and cut prices for promotion one day later.

Unexpectedly, it attracted a large number of customers and swept away the shops, and did not pay attention to whether they came to spend because they supported the products of "insulting enterprises" or wanted to use the products to sacrifice flags on the Internet.

In response to the Xinjiang issue, China has successively adopted counter-measures to sanction individuals and entities in the European Union, Britain, the United States and Canada. It will become the new normal for western countries to continue to compete with the rising China.

Nowadays, there is no absolute winner in global integration, but how to dismantle it is a difficult problem. UN Secretary-General Guterres said that the United Nations is negotiating with China and expects to allow UN personnel

Visit Xinjiang without restriction. By then, western countries will witness that there is no racial bullying in Xinjiang, and China will be able to slap them to appease the incident. The Hang Seng Index fell for five consecutive trading days and hit a year and a half

After the longest market decline since then, it finally rebounded last Friday and fell 1.2% in a week.

In Europe, the epidemic situation worsened again because of the variant virus, and Poland, one of the member countries, became out of control. The number of infected cases increased to about 30,000 every day, making it the second most newly infected country in Europe after France.

Moody's, a credit rating agency, said that Britain's consumer confidence recovered faster than that of the European Union, because the slower vaccination in other parts of Europe means that it is still far from returning to normal.

Strict epidemic restriction measures affecting consumers may make consumer confidence relatively weak. European stock markets performed well last week, and the German DAX index rose by 1.4%; The French CAC index fell 0.45%,

Britain's FTSE 100 index fell by 0.49%.

The economic growth figures of the United States last quarter exceeded market expectations, and the GDP of the fourth quarter was revised upwards. The labor market was also positive. Last week, the number of new jobless claims fell to a one-year low.

The number of people decreased by 97,000 every week, and the US dollar is now strong. When Federal Reserve Chairman Powell was interviewed last Thursday, he tried the water temperature, saying that when the US economy made substantial progress towards the bureau's goal, it began to reduce quantitative easing

There are also plans to raise interest rates under specific circumstances, but the policy must be transparent. Last week, the three major indexes of US stocks developed individually, with Dow Jones index and Standard & Poor's 500 index rising 1.4% and 1.6% respectively.

The Nasdaq index fell 0.6% for two weeks. Last week, the price of gold was still consolidating, with the highest price rising to US$ 1,745 per ounce. The economic data of the United States is improving, and the US dollar is now strong, which has hit the price of gold.

The lowest price is $1,722 per ounce, closing at $1,733 per ounce, closing at $1,733 per ounce, and falling by $13 a week.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/mingtakchat

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram