Realistic fairy tale

June 2 nd

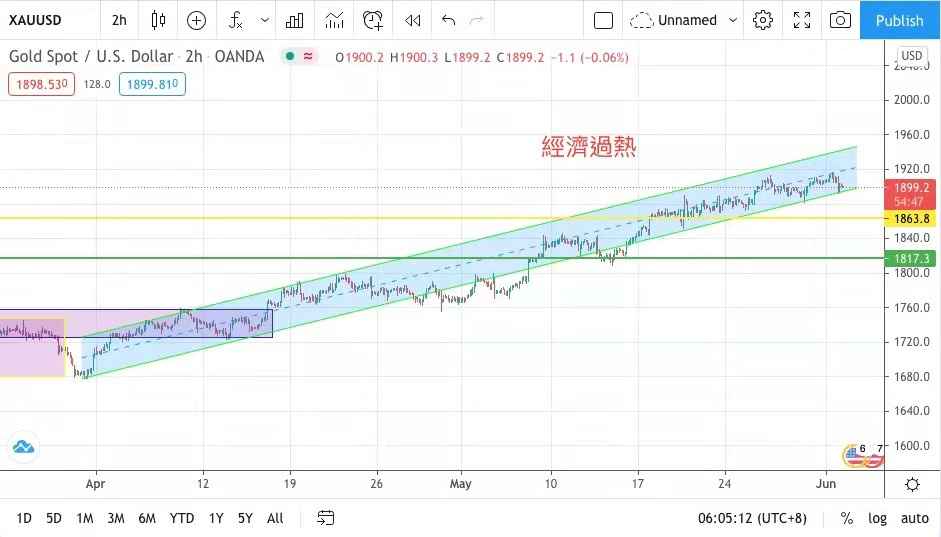

Today's volatility range:

The gold market is still at a high level. Yesterday, the US manufacturing data was ideal, the yield of US dollars and 10-year government bonds rebounded, the gold price fell under pressure, and finally closed at US$ 1900.

To risk the psychological barrier of $1,900. There are US non-agricultural data on Thursday and Friday. It is expected that the figures will continue to be revised downwards. Can we use this data to provide better admission opportunities?

It deserves our close attention. It is expected that today will still be a turbulent pattern, maintaining the suggested volatility from 1888 to 1912.

I have browsed a series of animal attacks on human beings on the Internet. One scene is particularly profound, that is, swans in the park feel threatened and constantly chase people passing by the park.

Because of the inherent beautiful image of swan in fairy tales, it is quite shocking when watching videos, and it also greatly changes the image of swan; But lately I've been thinking,

Can a goose with epilepsy be able to drive away a wolf who is gradually forced and gloomy? I don't know if anyone has uploaded or watched similar videos. Please share them to solve the author's doubts.

In reality, human beings will have similar behaviors, and there is great potential to hurt people in order to defend their own interests or revenge; But of course, there are some people who are willing to sacrifice themselves and do good deeds!

Take the election of the Chief Executive of Hong Kong as an example. Mr Leung Chun-ying, the former Chief Executive, retired in the last election and became the first Chief Executive of the Special Administrative Region in Hong Kong who could not stay in office successfully.

It may be because of great love or because the country needs him to play a certain role. Recently, Mr. Liang kept mentioning his former subordinate, the current Chief Executive, Ms. Carrie Lam Cheng Yuet-ngor.

A series of shortcomings in her administration are to expect her to have better achievements before the next election so as to enhance the trust of national leaders? !

Of course, the Chief Executive, Ms. Lin Zheng, has also received Mr. Liang's kindness and is doing her best. Recently, just to improve the epidemic situation, she can be regarded as scratching her head and twisting all the six wives. She can really quote a golden sentence from a local film.

"For the" Valley Needle ",you can go to a few places! According to media reports, the SAR government is studying measures to deal with the next wave of epidemics. In the future, new measures will restrict people who have not been vaccinated against COVID-19 from entering restaurants

Schools and other places, Chief Executive Carrie Lam Cheng Yuet-ngor said, "This is not to punish the public, so it is better not to use these measures. At present, the Hong Kong Government is really well-intentioned! The mainland manufacturing managers' index continued to improve,

Hong Kong stocks benefited. The Hang Seng Index rose by 316 points or 1.08% yesterday. The transaction was positive and may hit the 30,000 mark in the short term. However, the central government is regulating the liquidity of banks and announced that it will raise the foreign exchange of financial institutions in mid-June

The deposit reserve ratio is 2 percentage points, that is, the current deposit reserve ratio will be raised from 5% to 7% to prevent overheating of the economy and crack down on speculation. It is expected that Beishui will turn back at that time, although Hong Kong stocks will break

The traditional curse of the Five Poor Months, but the Six Wonders are very likely to happen.

In Europe, Germany, the United Kingdom and the Eurozone also released manufacturing-related data, showing that many European countries, except the United Kingdom, are in the post-COVID-19 epidemic era, looking forward to the gradual recovery of European economy.

The three major stock markets in European stock markets were built across the board, and the German DAX index rose by 0.96%; The CAC index in Paris, France rose by 0.66%; The FTSE 100 Index rose 0.86%. American manufacturing data is not behind Europe.

The United States announced yesterday that the Institute of Supply Management's manufacturing purchasing managers' index exceeded 61 points last month, indicating that economic activities are strengthening and demand is increasing, traditional economic stocks are building well, and Wall Street stock markets are developing independently.

Dow Jones index rose 0.14%, Nasdaq index fell 0.09% and Nasdaq index fell 0.07%. The gold market is still at a high level. Yesterday, the high and low volatility was 24 US dollars, and the highest price of gold rose to 1916 US dollars.

However, the US manufacturing data is ideal, the yield of US dollar and 10-year national debt rebounded, and the price of gold fell under pressure. The lowest price was US$ 1,892, and the US$ 1,888, which was challenged many times last week, was supported.

Finally, it closed at $1,900. Although it fell by $6, it still kept the psychological barrier of $1,900.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/mingtakchat

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram