It is also difficult to take off

June 9 th

Today's volatility range:

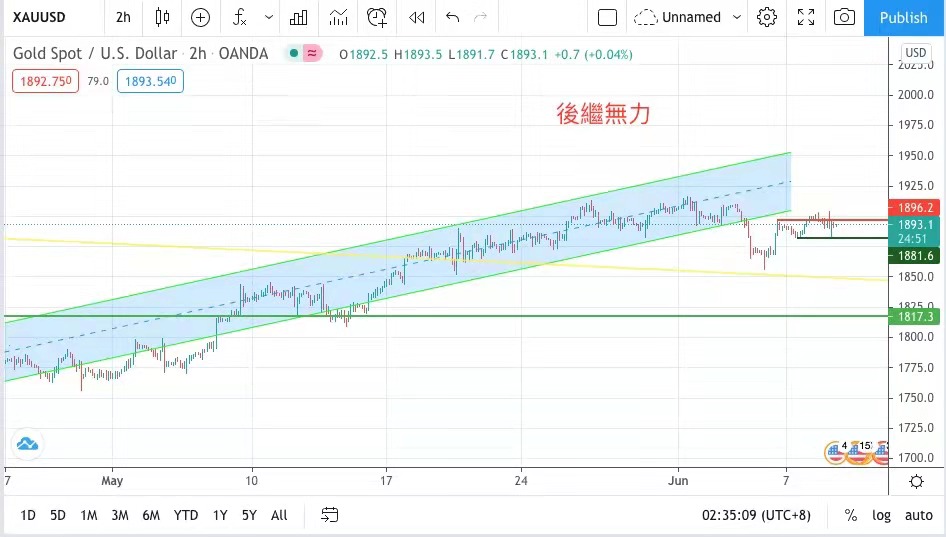

Yesterday, the price of gold continued to fluctuate, once rising above the psychological barrier of $1,900, but it was unsustainable, and it is expected to fluctuate in the short term. Today, the proposed amplitude is 1882-1904.

At the beginning of the COVID-19 epidemic, the global ban on flying was incessant and became a fatal blow to the aviation industry. Cathay Pacific, once one of the three major airlines in the world, was no exception, and fell into financial difficulties last year.

In October last year, it was announced that 8.5 thousand people were laid off in the world, and Hong Kong accounted for 62% of the reduction of the number of presidents, close to 5.3 thousand people, making it the largest single company layoffs in Hong Kong history.

At the same time, it announced the termination of its Dragonair operation. To support Hong Kong's continued role as an international aviation hub and drive other related economic activities, the Hong Kong Government has invested HK$ 30 billion to become shareholders.

And granted a transitional loan of HK$ 7.8 billion for one year. Yesterday, the Hong Kong Government accepted Cathay Pacific's request to extend the repayment period by one more year. However, the key is to deal with the epidemic situation. If the frequency of Hong Kong airport cannot be increased,

Cathay Pacific will be unable to repay the loan! Cathay Pacific is hard to take off again unless White Warrior buys Cathay Pacific!

Hong Kong stocks fell for four consecutive days, while Hang Seng Index continued to fall by 0.02%. The World Bank released the latest global economic forecast yesterday. The report raised the global economic growth rate to 5.6% this year, predicting that rich countries will be vaccinated by COVID-19,

Under the fiscal stimulus measures, it is expected to achieve the fastest growth year since 6.6% in 1973. However, the World Bank pointed out that the recovery is uneven, which largely reflects the sharp rebound of some major economies.

The most obvious is the United States, which is highly unequal in vaccine access opportunities due to massive financial support. It calls on rich countries including the United States to release excess vaccine doses to developing countries as soon as possible.

The World Bank raised the growth rate of global economies, including the following four strongest regions in the world: the US economy increased by 3.3% to 6.8%, the Eurozone by 0.6% to 4.2%, and China by 0.6% to 8.5%.

Japan is expected to achieve an economic growth of 2.9% this year. However, the World Bank warned that there are still variables in these economic forecasts, including the possibility of epidemic warming, the intensification of inflation forcing the central bank to raise interest rates,

And that heavy debt burden face by all countries.

The three major European stock markets are mixed. German stock market fell alone, DAX index fell 0.24%; The CAC index in Paris, France rose by 0.11%; The FTSE 100 Index rose 0.23%. The three major indexes of Wall Street stock market developed independently,

Dow Jones index fell 0.09%, Nana Standard & Poor's 500 index fell 0.02%, Nasdaq index rose 0.32%. Last month, the Bank of Canada announced the result of interest rate decision, keeping the benchmark interest rate unchanged at 0.25%.

And said that the economic recovery impacted by the epidemic continued to need special monetary policy support. At that time, the Bank of Canada announced that it would cut its weekly bond buying scale from 4 billion Canadian dollars to 3 billion Canadian dollars, and hinted that it would resume raising interest rates as soon as next year.

Canada took the lead in becoming the first country in America to start defending. Today, the Bank of Canada will announce the interest rate decision again. It is certain that the interest rate decision will remain unchanged.

However, it is worth paying attention to whether it will reduce the scale of debt purchase again, or use tougher language to affect the foreign exchange market, especially the performance of the US dollar. Yesterday, the price of gold continued to fluctuate. The price of gold rose to the psychological barrier of 1,900 US dollars.

The highest price was $1,904, but the strength was not sustained, and it quickly returned to $20. Yesterday, the lowest price was $1,884, and finally closed at $1,893, down $6.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/mingtakchat

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram