Bottle neck

July 13 th

Today's volatility range:

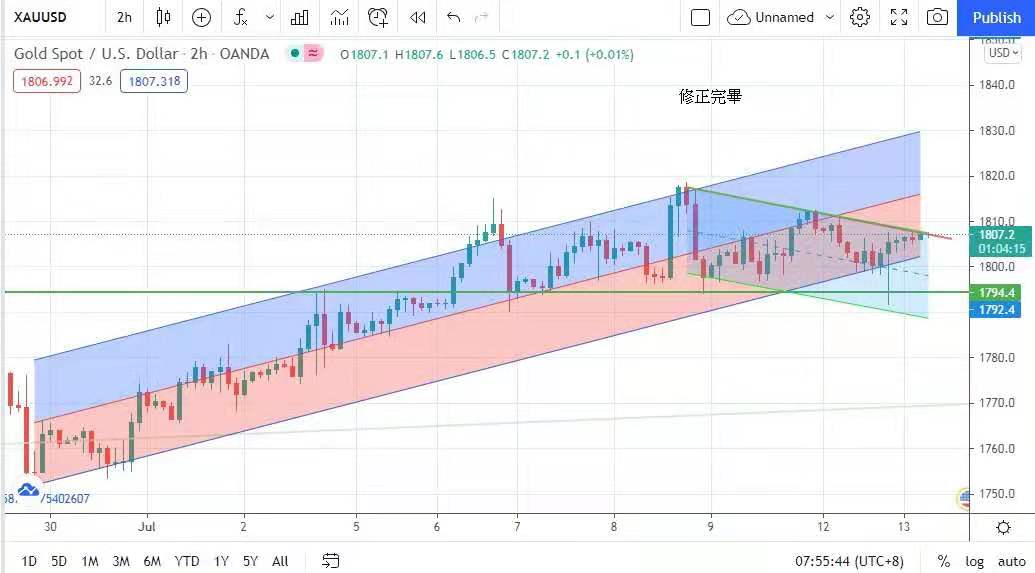

The gold market once again showed a one-day turn. The strength of the US dollar and the stock market suppressed the performance of gold. The price of gold once fell below the $1,800 mark, and the lowest was $1,792. It turned into a long-term low-sucking opportunity and finally rebounded

By the close of $1806, although there was a candle, it was enough to prove that $1800 had become a long-term position! Investors should pay attention to the US core consumer price index data for June tonight, economists

It is generally believed that the figure will increase by 0.4% compared with May, and the rising inflation will have the opportunity to trigger the Fed to reduce its debt buying schedule earlier. The gold price has been corrected after falling sharply in June, and is now consolidating.

Today's proposed amplitude is between 1795 and 1812.

On the other hand, the mainland will implement a comprehensive RRR cut on the 1st and 5th of this month, and the People's Bank of China will cut the deposit reserve interest rate of financial institutions by 0.5%. The measures will provide more than RMB 1 trillion in liquidity, which is beneficial to economic development.

Although officials of the Ministry of Finance denied the adjustment of monetary policy, the second RRR cut shows that China's economic growth is at a neck, and it is expected to release water to stimulate the economy to recover its disadvantages. The Hong Kong Special Administrative Region, which is separated from the motherland by a river.

It is also facing an economic test. Under the ravages of the COVID-19 epidemic that lasted for a year and a half, Hong Kong is almost closed, and all walks of life are almost stagnant. Although the data released by Hong Kong officials and official agencies all point to the economic recovery,

However, a university conducted a telephone survey to Hong Kong people in June, and the survey report showed that the people still lacked confidence in the future. According to the university survey, the overall consumer index of Hong Kong recorded 65.7 this quarter, compared with the previous quarter

It increased by 5.3%, but still decreased slightly by 0.8% year-on-year. In the statistics of sub-projects, the five categories of employment, economic development, investment in stocks, purchase of houses and consumption status have increased compared with the previous quarter;

Among them, the employment index rose the most, with 16.7%. It is estimated that the government reopened several forbidden places and restarted the labor force in this industry.

The report pointed out that consumers' confidence in the price situation dropped by 21.6%, indicating that the economic recovery rate lags behind inflation. In addition, the report pointed out in the summary that the index in all survey areas is insufficient

78 (out of 200), indicating that Hong Kong people's confidence in the economic prospects is still at a low level. The news of overall RRR cut continued to stimulate Hong Kong stocks to rise, and Hang Seng Index rose by 0.67%. The European Union announced a reassessment of the digital tax collection plan,

Decided to suspend the taxation plan introduced at the end of this month. The EU explained that suspending the introduction of digital tax allowed the EU to focus on the negotiation of the global minimum tax agreement reached by the G20 earlier.

It is important to know that American giant companies have swept the world, with a few monopolies, and European companies are rarely the rivals of these giants. After the branches of American giant companies settled in Europe, they could not share their economic achievements because of the loopholes in the tax system.

The European Union can be said to love and be cruel to the American Internet giant. Earlier, it repeatedly accused Gu Ge, hoping to require the company to dismantle its bones in Europe through anti-monopoly law, so that European companies can join the competition.

The investment community generally believes that the European Union has given way to the pressure from the United States, and hopes to make another plan in the global taxation. The three major indexes of European stock markets have performed unevenly in the past week, and the German DAX index rose by 0.64%; CAC Paris, France

The index rose by 0.46%; In Britain, the FTSE 100 index rose by 0.05%. The ideal of the external stock market, coupled with the announcement of the European Union to suspend the introduction of the taxation plan at the end of this month, eliminated the uncertainty of the after-tax profits of American high-tech enterprises.

For two consecutive days, new york's three major indexes hit a new high, Dow Jones index rose 0.37%, Standard & Poor's 500 index hit a new high, up 0.38%, and Nasdaq index rose 0.21%. The gold price took on last Friday's upward trend in the early stage.

The highest price was $1,811, but the strength of the US dollar and the stock market suppressed the performance of gold. The gold price once fell below the $1,800 mark, and the lowest was $1,792. After that, it rebounded to $1,806 and closed again, showing a one-day turn.

A slight drop of $2.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/mingtakchat

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram