Are bank balances linked to the linked exchange rate?

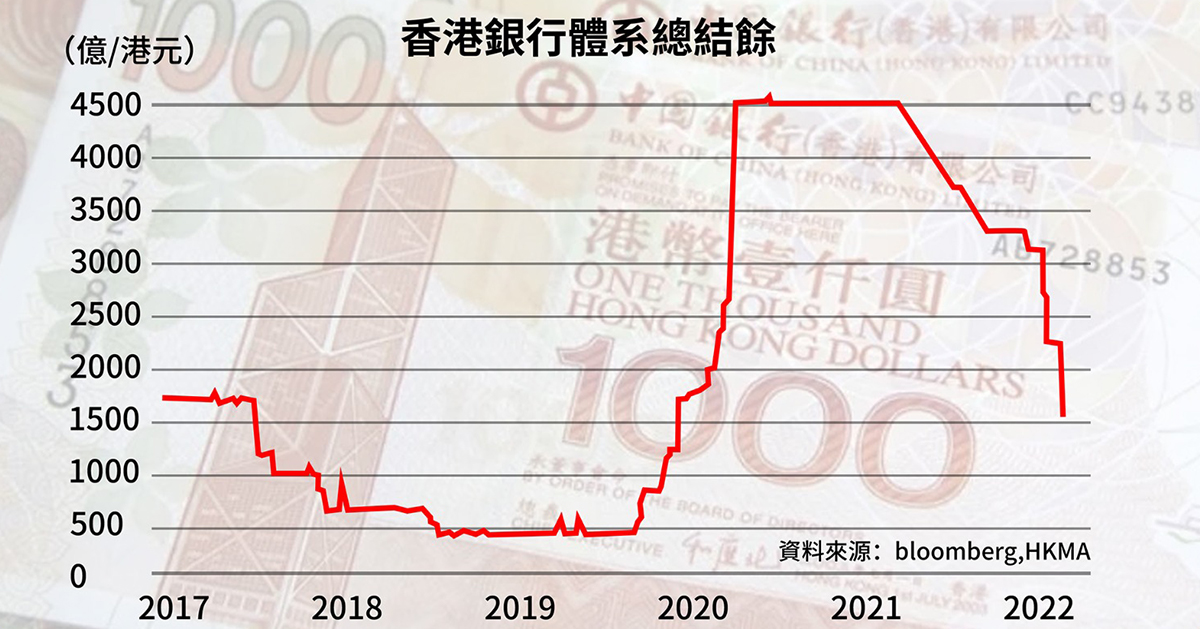

Since the interest rate hike in the United States in March this year, the interest rate has accelerated upward. Influenced by the interest rate spread, hot money continues to flow out of the local banking system, and has recently dropped to 126.2 billion, losing nearly half of the balance in a few months.

The pressure to raise interest rates in Hong Kong is getting higher and higher, and the burden on mortgage payers has also increased. However, the balance of the banking system is related to American interest rates, interest rates and linked exchange rates. The solution will be interlocking? Banking system

Balance refers to the daily balance of accounts opened by registered banks in Hong Kong with the HKMA. Under the linked exchange rate policy, the balance will increase or decrease because of the inflow or outflow of Hong Kong dollar funds from the market.

However, if funds flow into Hong Kong dollars, that is, market participants buy Hong Kong dollars and Hong Kong dollars strengthen against the US dollar, the HKMA will guarantee the sale of Hong Kong dollars with a strength of 7.75, the monetary base will expand, and interest rates will also be affected by

However, with this decline, the exchange rate of the Hong Kong dollar has once again stabilized within the guaranteed range. However, the current situation is just the opposite. As the Federal Reserve continues to raise interest rates, investors have a larger interest return on saving money in the US dollar, attracting investment.

Gold flows into the US dollar market, the interest spread widens, the balance of the Hong Kong dollar system shrinks, and the inter-bank lending rate has gone up. Therefore, mortgage payers need to repay more interest. The market generally expects silver

If the system balance drops below 100 billion yuan, Hong Kong needs to start raising interest rates to attract market funds back to Hong Kong. What will happen if Hong Kong still doesn't raise interest rates? If the capital continues to flow away, Hong Kong

If the interest rate is not raised, the capital will continue to be lost, which will lead to the Hong Kong government or the HKMA lacking sufficient reserves to defend the linked exchange rate, and eventually force the Hong Kong government to break the peg. The situation is just like the Asian financial turmoil in 1997, when the predators demanded

Ross argued that many emerging markets in Asia did not have enough reserves to safeguard exchange rate stability. Thailand, Taiwan Province and so on gave up maintaining exchange rate stability one after another, and a sharp drop in currencies was an inevitable result. This is also the third in economics.

Paradox, if an economic system wants to remain open and fix the exchange rate, it cannot decide the market interest rate independently. Open economy, exchange rate and interest rate, there are only three choices. If Hong Kong is to remain open

If the economy is to be linked to the exchange rate, it must eventually follow the change of interest rate in the United States.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram